Summary

This week’s watchlist highlights Goldman Sachs (GS), Citigroup (C), and JPMorgan (JPM) as they approach key technical levels that could trigger major upside moves. Each setup comes down to patience and price discipline — wait for the dip, then strike.

Economic Data

- 📈 US Bank Holiday: Oct 13, 2025

- 📈 Fed Chair Powell Speaks: Oct 14, 2025

📚 Deep Dive 📚

Weekly Watchlist: GS, C, and JPM — Big Banks Setting Up for Major Moves

Every Sunday, we post our 5-stock watchlist inside the GAR Capital Discord for our Options Members and Masterclass Students. Today, we’re giving you a sneak peek at 3 of those names, all from the big banking sector, which is setting up for potential breakout moves.

Let’s break it down in simple terms 👇

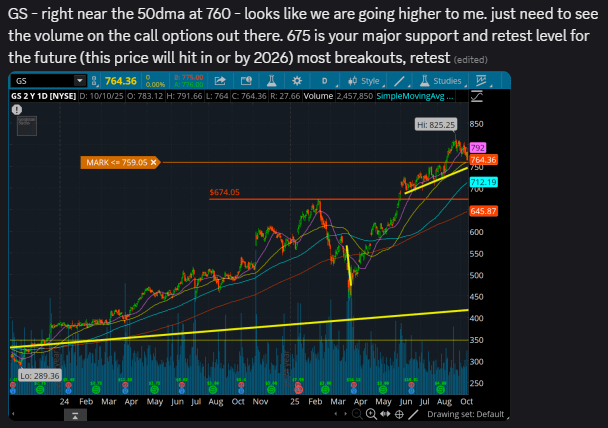

🟡 Goldman Sachs (GS) — Holding Strong at Support

GS is sitting right on its 50-day moving average around $760, which has been acting like a launchpad for the stock. As long as it holds that level, the trend looks bullish.

- Major Support / Retest Level: $675 — this is where GS would likely bounce hard if it ever drops.

- Current Setup: Needs more call option volume to get momentum going.

- Future Outlook: We expect GS to eventually hit $800+, possibly by 2026 or sooner.

Carlos G. on our Discord server Watchlist Channel: _Game Plan:* Watching for calls off the 50-day MA bounce. Dips toward $700–$720 are accumulation zones.

_Game Plan:* Watching for calls off the 50-day MA bounce. Dips toward $700–$720 are accumulation zones.

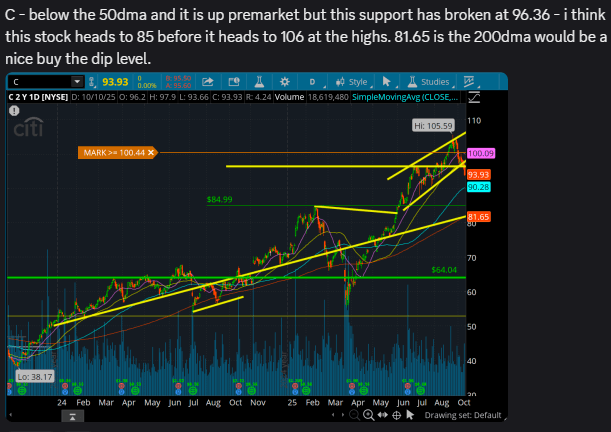

🔵 Citigroup (C) — Wait for the Dip

C broke below its 50-day moving average, which means it may have one more pullback before heading higher.

- Broken Support: $96.36 — now acting as resistance.

- Expected Pullback Zone: $85

- Best Buy Level: $81.65, which is the 200-day MA — a classic dip-buy level.

Carlos G. on our Discord server Watchlist Channel: _*Game Plan:Patience. If price drops into the $85–$82 range, that’s where we look for calls or shares for a move back to$100+**.

_*Game Plan:Patience. If price drops into the $85–$82 range, that’s where we look for calls or shares for a move back to$100+**.

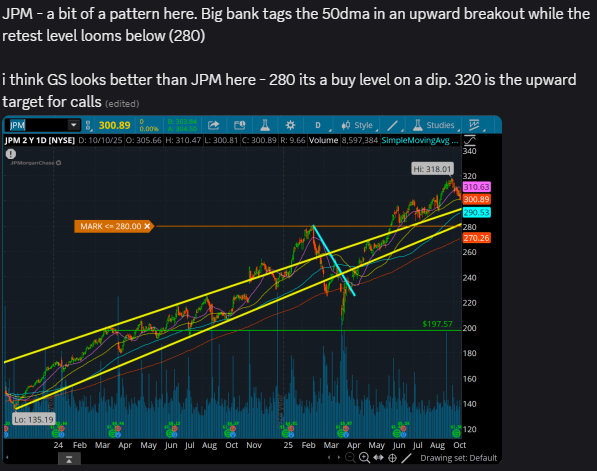

🟢 JPMorgan (JPM) — Strong Trend, Just Needs a Pullback

JPM has a clear pattern: it tags the 50-day MA, pushes higher, then comes back to retest lower levels before continuing up.

- Current Resistance: Around $300

- Best Buy Level: $280

- Upside Target After the Dip: $320

Carlos G. on our Discord server Watchlist Channel: _Game Plan:* Let it come to us. If JPM dips to $280, that’s our ideal entry for calls.

_Game Plan:* Let it come to us. If JPM dips to $280, that’s our ideal entry for calls.

✅ Quick Summary

| Stock | Best Buy Zone | Upside Target |

|---|---|---|

| GS | $700–$720 or 50-day MA | $800+ |

| C | $85–$82 (200-day MA) | $100+ |

| JPM | $280 | $320 |

These setups are not financial advice — just our trade planning process. As always, patience pays. Let the price come to your levels instead of chasing.

If you want access to all 5 watchlist stocks every week, plus entries, exits, and live trade alerts, join us inside the GAR Capital Discord.