Summary

Amazon, Coinbase, and SoFi are lining up with notable technical levels and upcoming catalysts that could drive meaningful price movement. This watchlist breaks down the key zones, trend direction, and what we want to see before taking action on each name.

Economic Data

- 📈 FOMC Statement & Rate Decision: Oct 29, 2025

- 📈 Daylight Saving Time Shift: Nov 2, 2025

📚 Deep Dive 📚

📈 Weekly Watchlist — COIN, SOFI, AMZN

Every week we break down the charts, key levels, and game plans for the setups that matter most.

This week, we’re focusing on three names (pubicly - members have over 6 this week) that continue to show strong positioning into November: COIN, SOFI, and AMZN.

🟡 COIN (Coinbase)

Key Level to Hold: $350 (20-day moving average)

Short-Term Focus: Upside continuation

End of Year Target: $400 (possibly conservative)

COIN continues to act as one of the best Bitcoin-proxy trades for options traders. As long as price holds above $350, momentum and trend strength remain intact. Bitcoin strength = COIN strength.

MARA tends to be more volatile and inconsistent — COIN remains the cleaner options vehicle.

Game Plan:

- Look for higher-low setups above $350

- Calls can be used to position into November/December

- The $400 level is a reasonable target, and potentially higher if crypto momentum accelerates

_*Bottom Line:*If crypto keeps pushing, COIN isthe* vehicle we want exposure in.

_*Bottom Line:*If crypto keeps pushing, COIN isthe* vehicle we want exposure in.

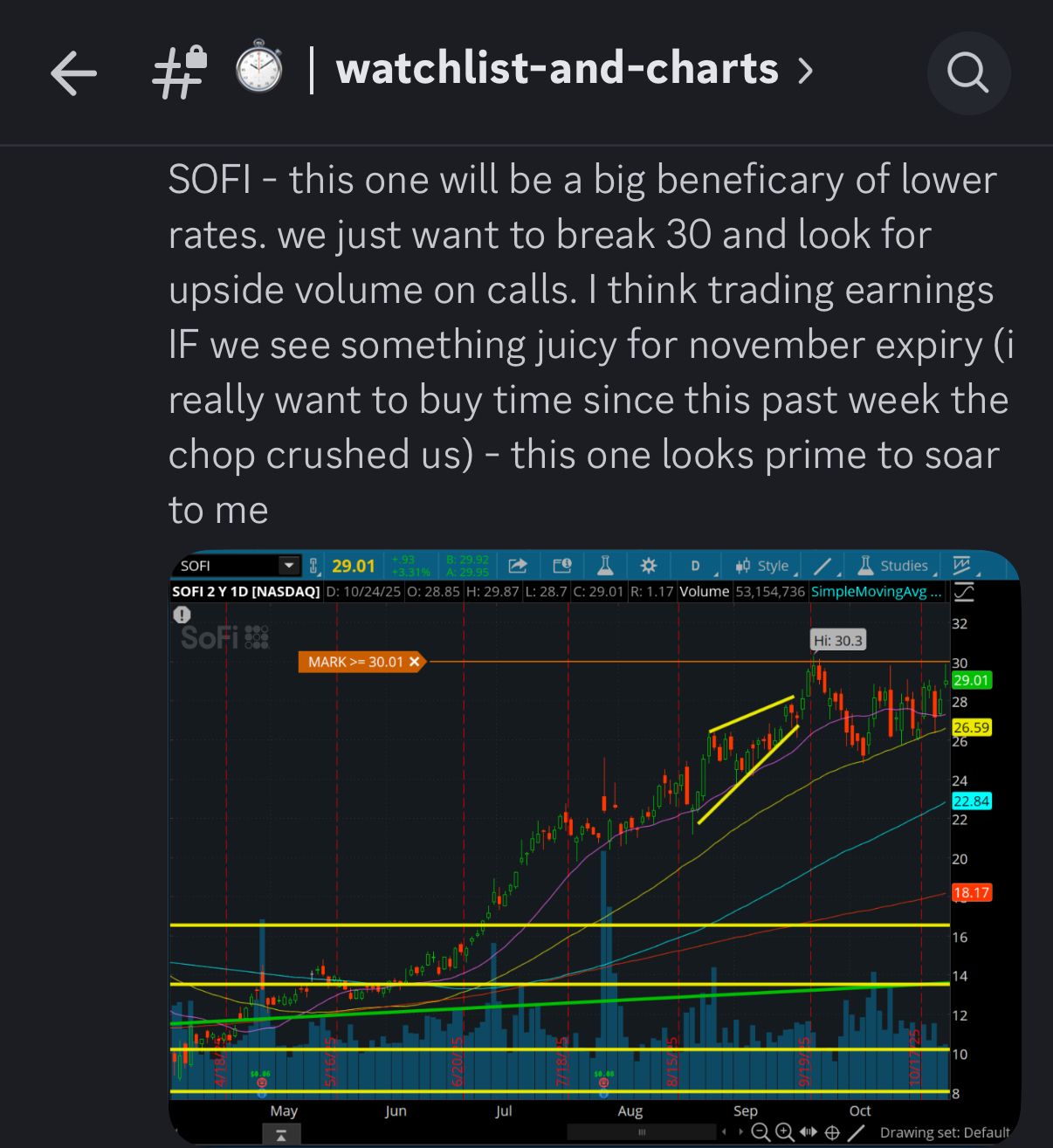

🟢 SOFI

Key Break Level: $30

Theme: Beneficiary of lower interest rates

Setup: Range breakout with volume confirmation

SOFI is setting up for a bigger move, but we want to see it close and hold above $30 with strong call volume behind it. Lower rates are a tailwind for financial and lending platforms like SOFI — and the chart is beginning to show that.

We may trade this with earnings if November expiry contracts offer good pricing + volume. The goal is to give the trade time rather than forcing short-dated weekly calls.

Game Plan:

- Watch for push > $30 + volume surge

- Consider November expiry call options to buy time

- Avoid rushing entries during chop — we want momentum

_*Bottom Line:*This one looksready* — patience is key, let it confirm.

_*Bottom Line:*This one looksready* — patience is key, let it confirm.

🔵 AMZN (Amazon)

Key Support Held: $212 (strong bounce)

Trigger Confirmation: $230

Target Idea After Earnings: $240 strike calls for November

AMZN has earnings this week. It defended the $212 support cleanly, which is a very constructive sign. However, IV (implied volatility) is high into earnings, meaning option prices are elevated.

Rather than paying inflated premium, we may wait for the report and then target upside calls once IV comes back down.

Game Plan:

- Let earnings happen — avoid overpaying IV

- If price pushes through $230 after earnings:

- Target $240 calls into November

_Bottom Line:*

_Bottom Line:*

The setup is bullish — we just want to be smart with timing and premium.

✅ Final Takeaways

| Ticker | Key Level | Strategy | Target |

|---|---|---|---|

| COIN | Hold > $350 | Crypto momentum play | $400+ |

| SOFI | Break + hold > $30 | Wait for volume, buy time | Trend continuation |

| AMZN | > $230 post-earnings | Avoid high IV, strike after report | $240 November calls |

This week is about confirmation, not chasing. Let the levels speak — we’ll react, not guess.

Want the live entries and exits?

They’re posted in real-time inside the Discord.