Summary

In May 2025, GAR Futures outperformed every major asset — from S&P and Nasdaq futures to gold and BTC. With 84% wins and $5,188 in net profit, the team posted a +20.7% return by sticking to high-conviction breakout setups. Volatility didn’t rattle us — it fueled us.

Economic Data

- 📈 FED Chair Powell Speaks at 8:30am ET: Jun 2, 2025

- 📈 JOLTS Job Openings 10:00am ET: Jun 3, 2025

- 📈 ADP Non-Farm Employment Change 8:15am ET: Jun 4, 2025

- 📈 NFP Non-Farm Payrolls 8:30am ET: Jun 6, 2025

📚 Deep Dive 📚

+$5,188 Net | +20.7% Monthly Return | 84% Win Rate

Crushing ES, NQ, GC, YM, and BTC performance

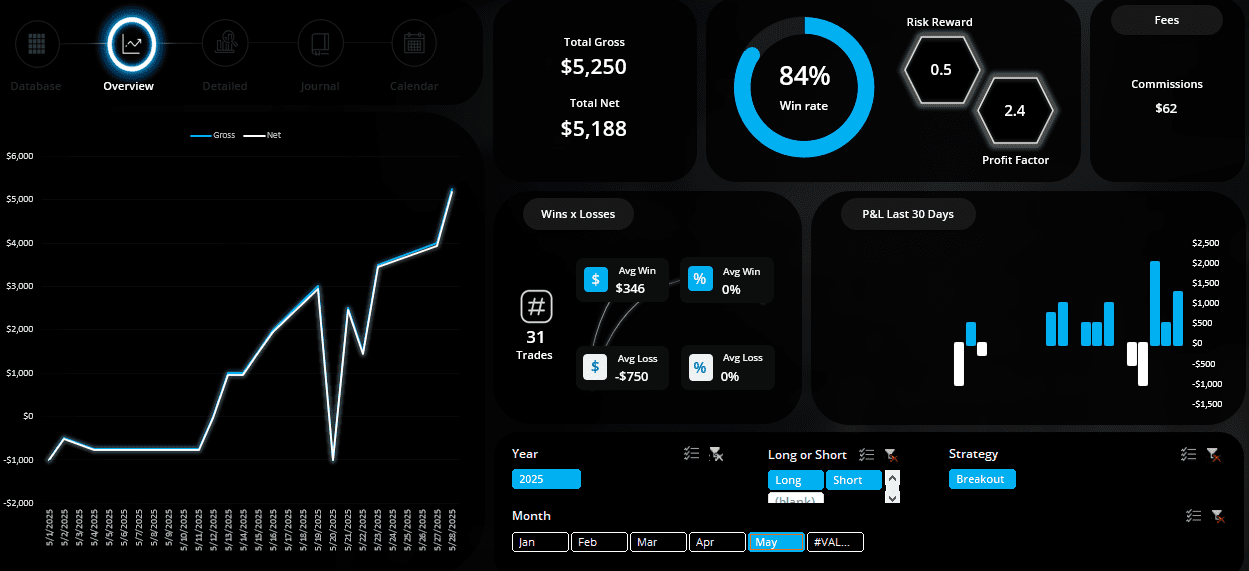

May was a big month for GAR Capital Futures, with a net gain of $5,188, a +20.7% return on a $25,000 trading balance, and a stellar 84% win rate across 31 trades. While the broader futures markets chopped and drifted, our breakout strategy on MES (S&P 500 E-mini Futures) delivered consistent alpha.

Let’s break down the stats and how we stacked up against the benchmarks.

🔢 GAR Capital Futures – May Stats:

📊 Total Trades: 31

✅ Wins: 26

❌ Losses: 5

💰 Net Profit: $5,188

📈 Monthly Return: +20.7%

🎯 Win Rate: 84%

💥 Profit Factor: 2.4

⚖️ Risk/Reward Ratio: 0.5

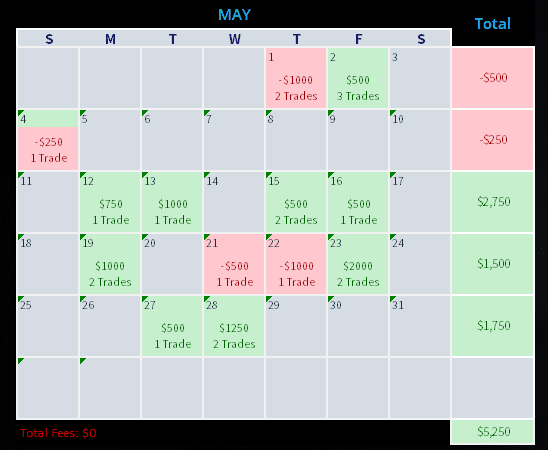

🏆 Biggest Win: $2,250 (May 28 – ES Long Post-NVDA)

💀 Biggest Loss: –$1,000 (May 22 – ES)

Our Futures Trading Journal - a MUST have for serious traders who want to track their strategy and trades:

💥 GAR Futures Team outperformed all major futures indices and crypto.

While the indices delivered modest gains — and Gold/BTC fell — we used structure and strategy to extract value in both trending and choppy sessions.

📊 GAR Futures Net P/L for May: +$5,188

Despite starting red, we stayed patient and trusted our system — turning the second half of the month into a clean win streak.

📊 How We Performed vs. Major Markets:

Asset/Futures Contract May 2025 Return:

- GAR Capital Futures +20.7% ✅

- S&P 500 (ES) +4.8%

- Nasdaq 100 (NQ) +6.1%

- Dow Jones (YM) +2.3%

- Gold Futures (GC) –1.2%

- Bitcoin (BTC) –1.5%

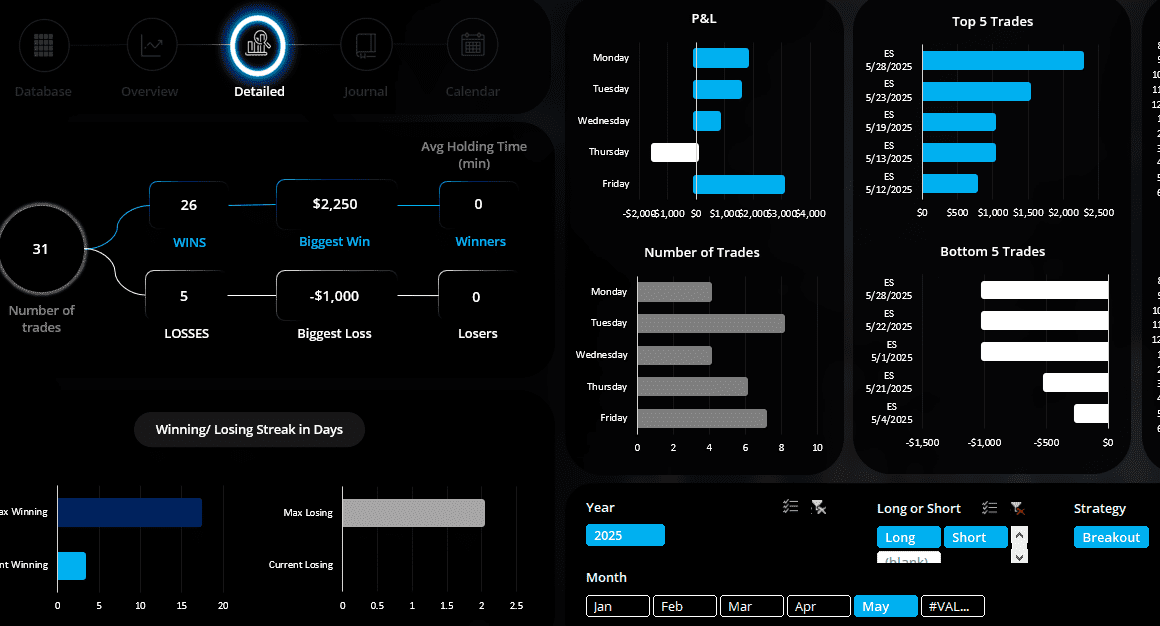

🧠 What Worked:

🔍 Breakout Structure: Entries based on clear resistance/support flips

📈 MES Execution: Tight stops, multiple take-profits, and real-time alerts in Discord

💡 Post-Earnings Volatility: Especially around NVDA, delivered our largest win

🙅♂️ No Overtrading: Only high-quality setups taken

📅 Calendar Recap:

✅ 17 Green Days, just 4 Red Days

📌 Strongest days: Tuesdays and Fridays

🧠 After every red day, we reset — no revenge trades, just clean recovery showing true discipline

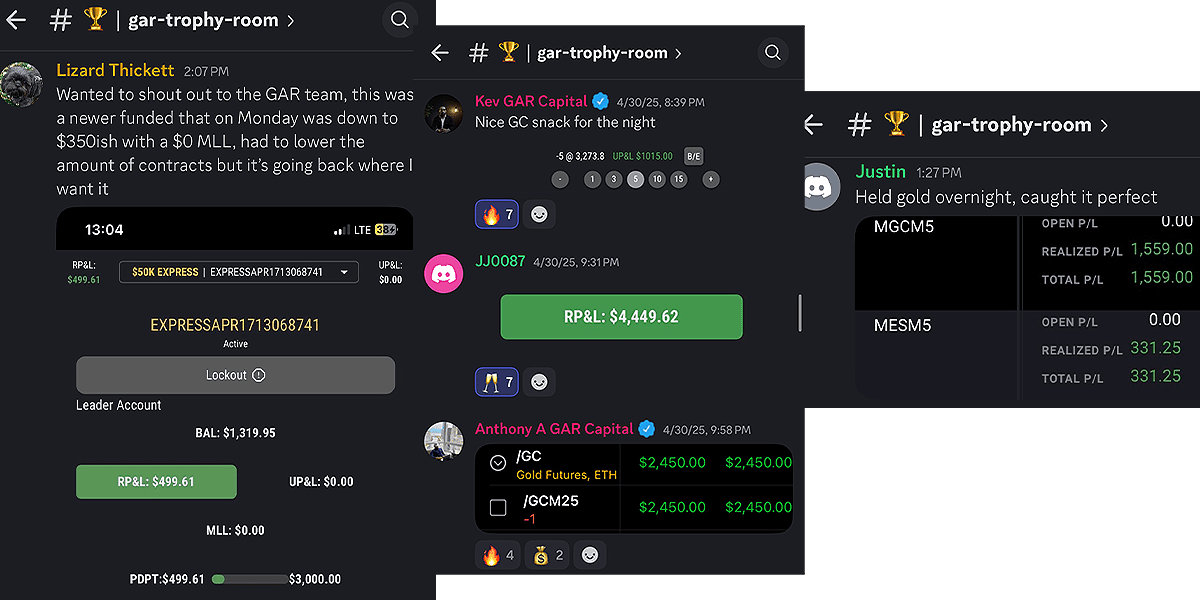

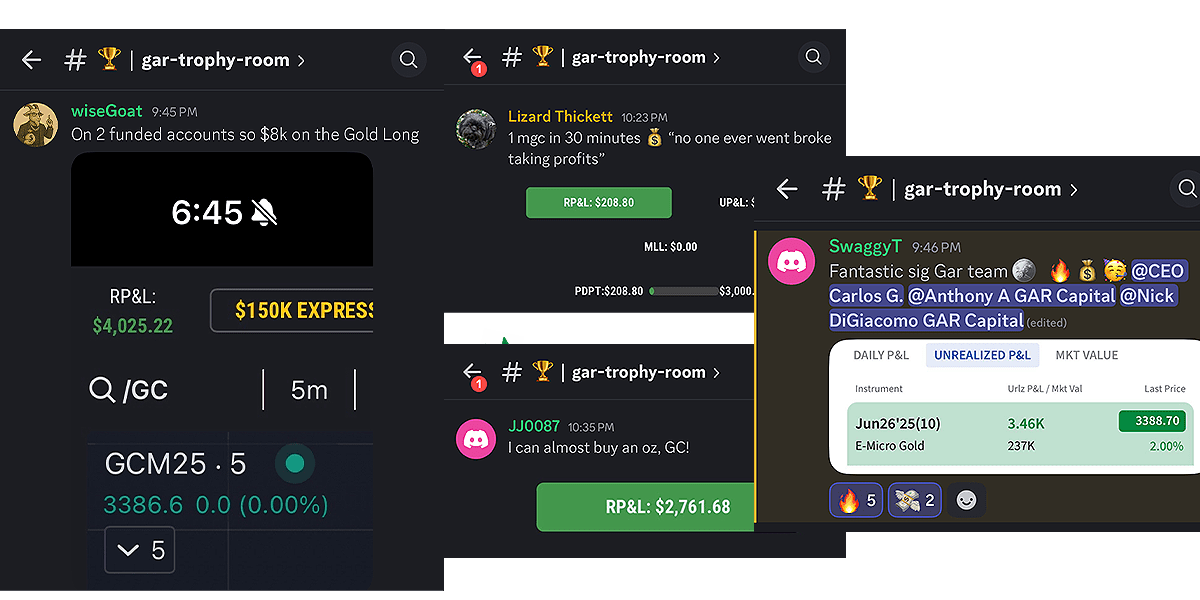

Trophy Room things from our Students/Futures Members:

🔚 Final Thoughts:

May reminded us why futures trading is a game of discipline, not prediction. With a YTD return now at 200%, GAR Futures continues to outperform markets — not by guessing direction, but by executing structure with conviction.

We didn't just beat the market — we beat every major futures index and asset class by a wide margin. On to June - same focus, same edge. See you all on the trading floor - CEO Carlos G. GAR Capital