Summary

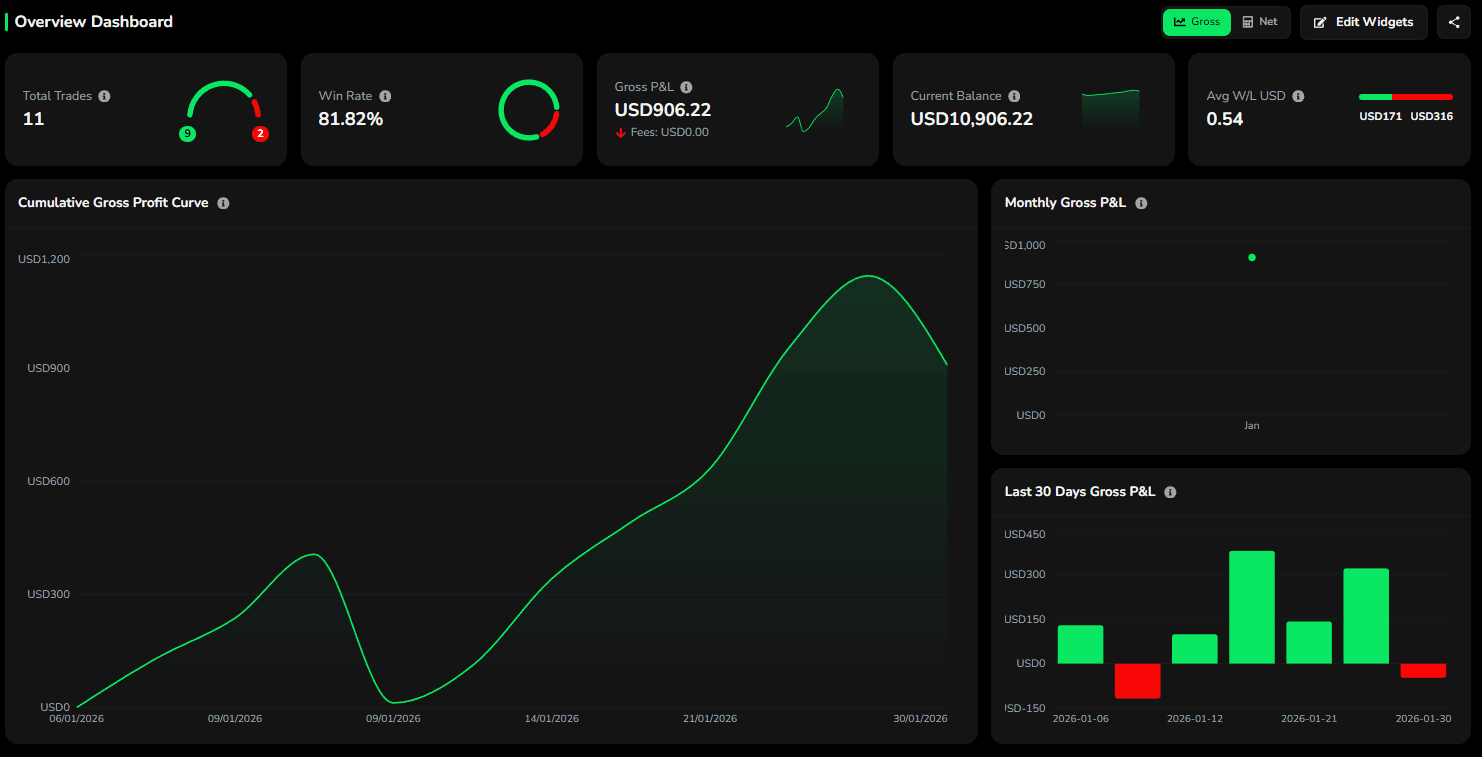

January was a disciplined and methodical month for our options trading strategy. With only 11 total trades, we focused on high-probability setups, proper risk control, and patience around entries. The result was a +$906.22 gain on the month and an 81.82% win rate, driven largely by strong performance in energy, commodities, and select index plays. While a few losses reinforced the importance of respecting invalidation levels, overall execution remained tight and repeatable.

Market Watch

Economic Data

📚 Deep Dive 📚

January 2026 Options Trading Recap: Discipline Wins

January was a strong start to the year for our options trading alerts. While not every trade was perfect, the process held, risk stayed controlled, and the edge showed up where it mattered.

Below is a clean breakdown of performance, key stats, what worked, and what we’re refining going forward. This trading journal is based on a $10,000 starting value.

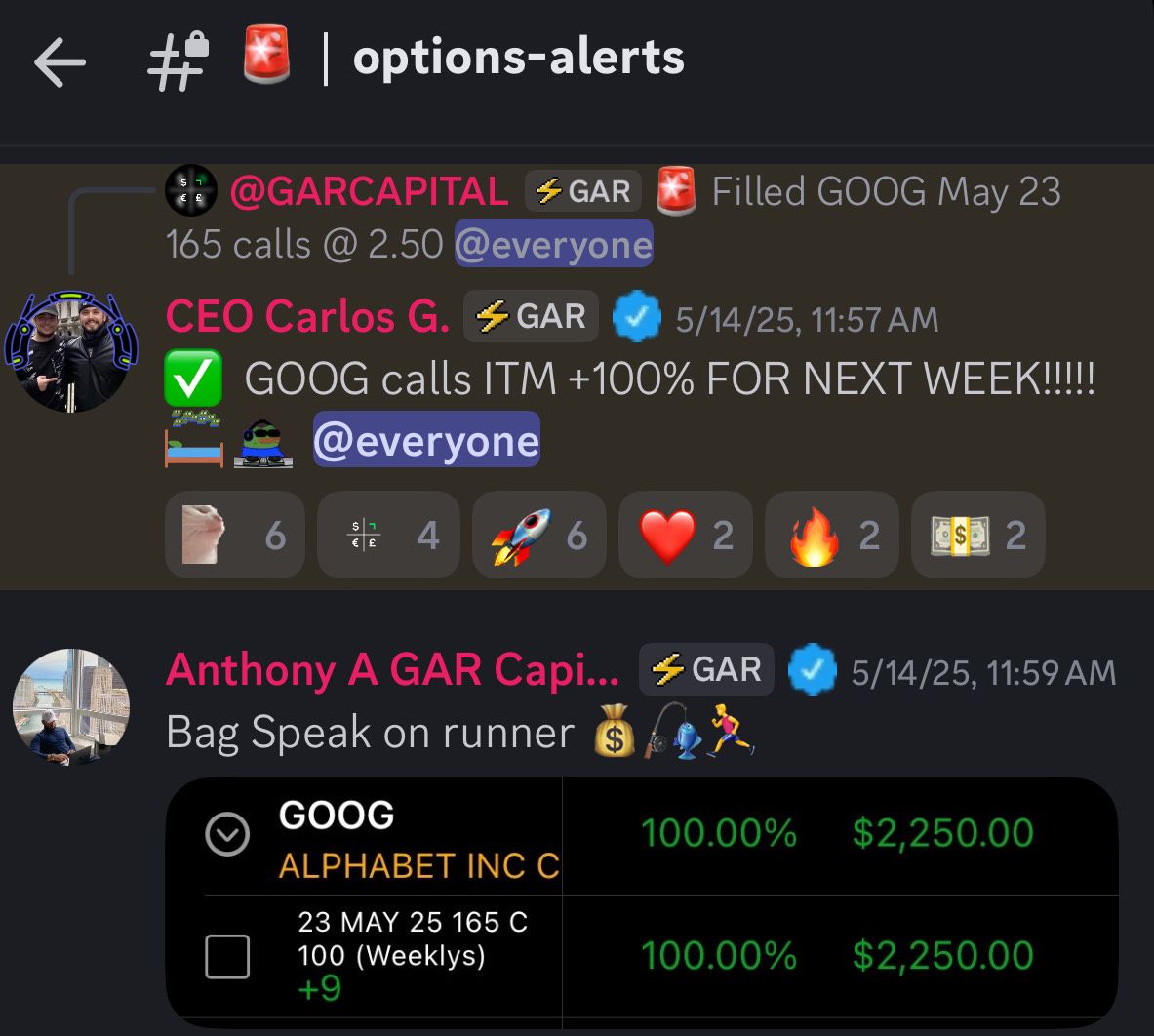

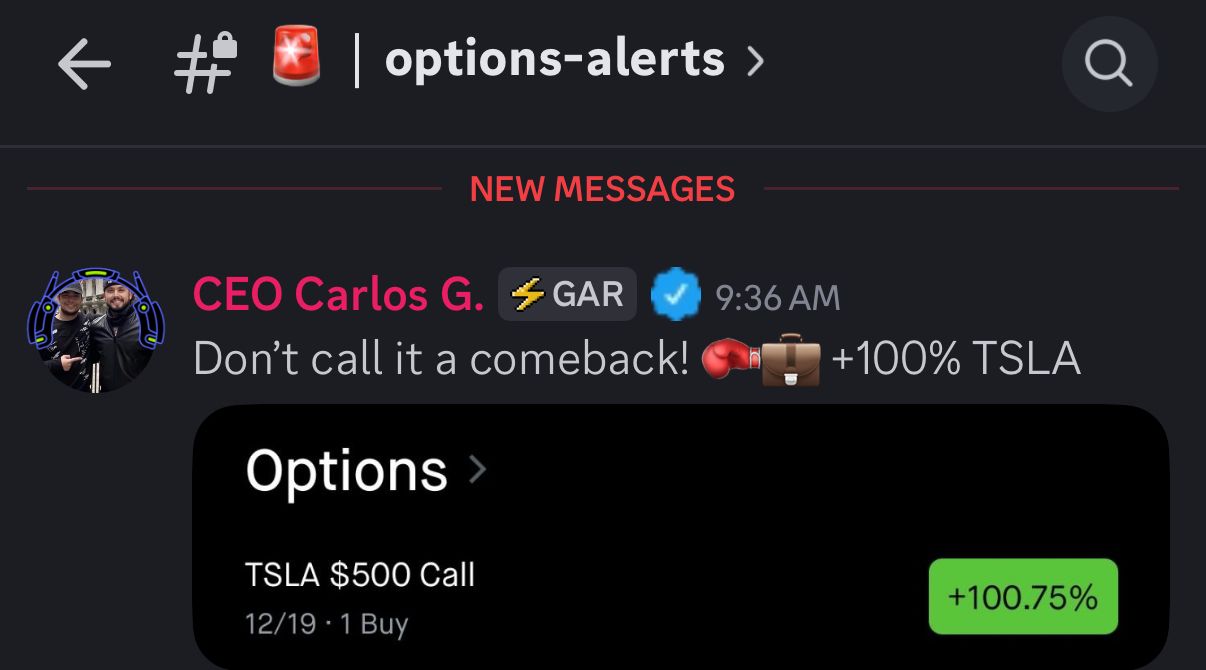

Note: this does NOT include runners which were much higher returns, also does not include Futures, stocks, or Masterclass trad alerts.

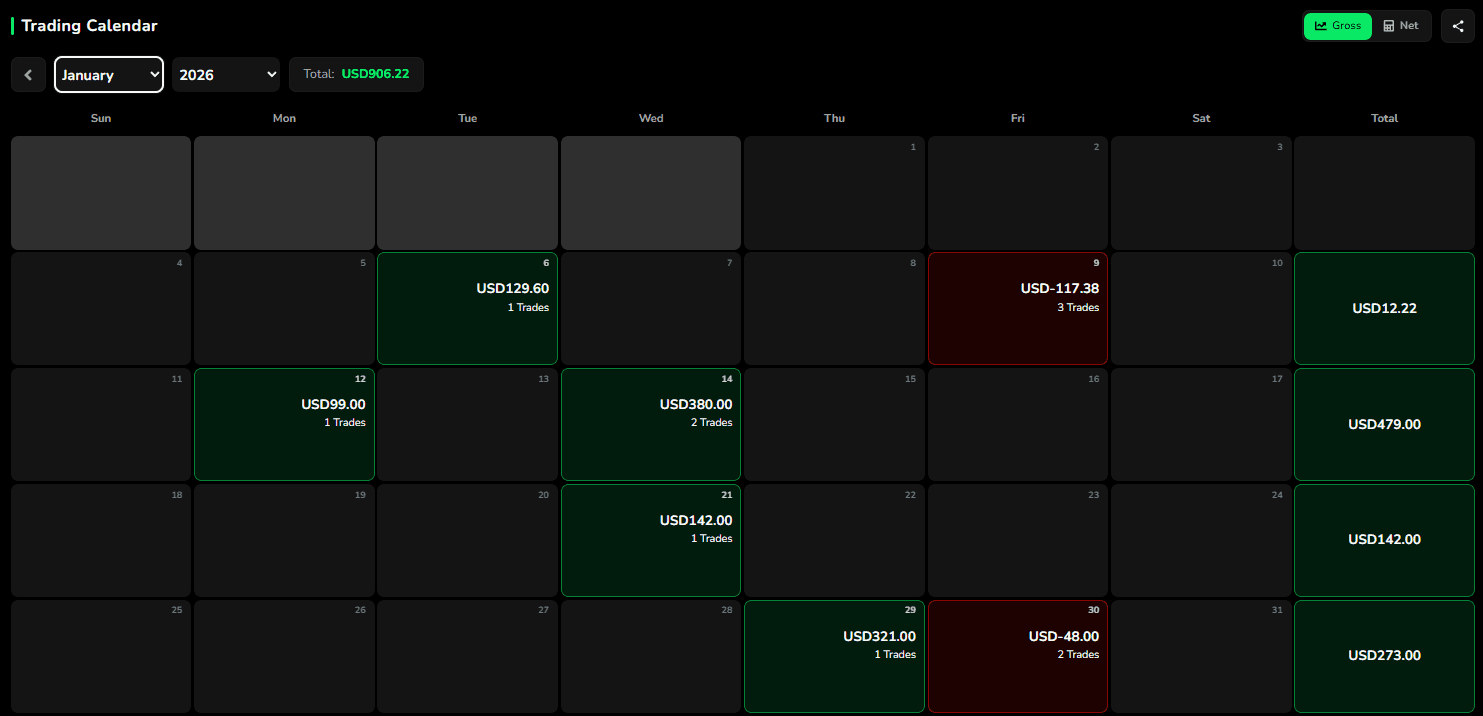

January Performance Snapshot

- Gross P&L: +$906.22

- Starting Balance: $10,000

- Ending Balance: $10,906.22

- Total Trades: 11

- Win Rate: 81.82%

- Winning Trades: 9

- Losing Trades: 2

This was not an overtrading month. Fewer trades, higher conviction, tighter execution.

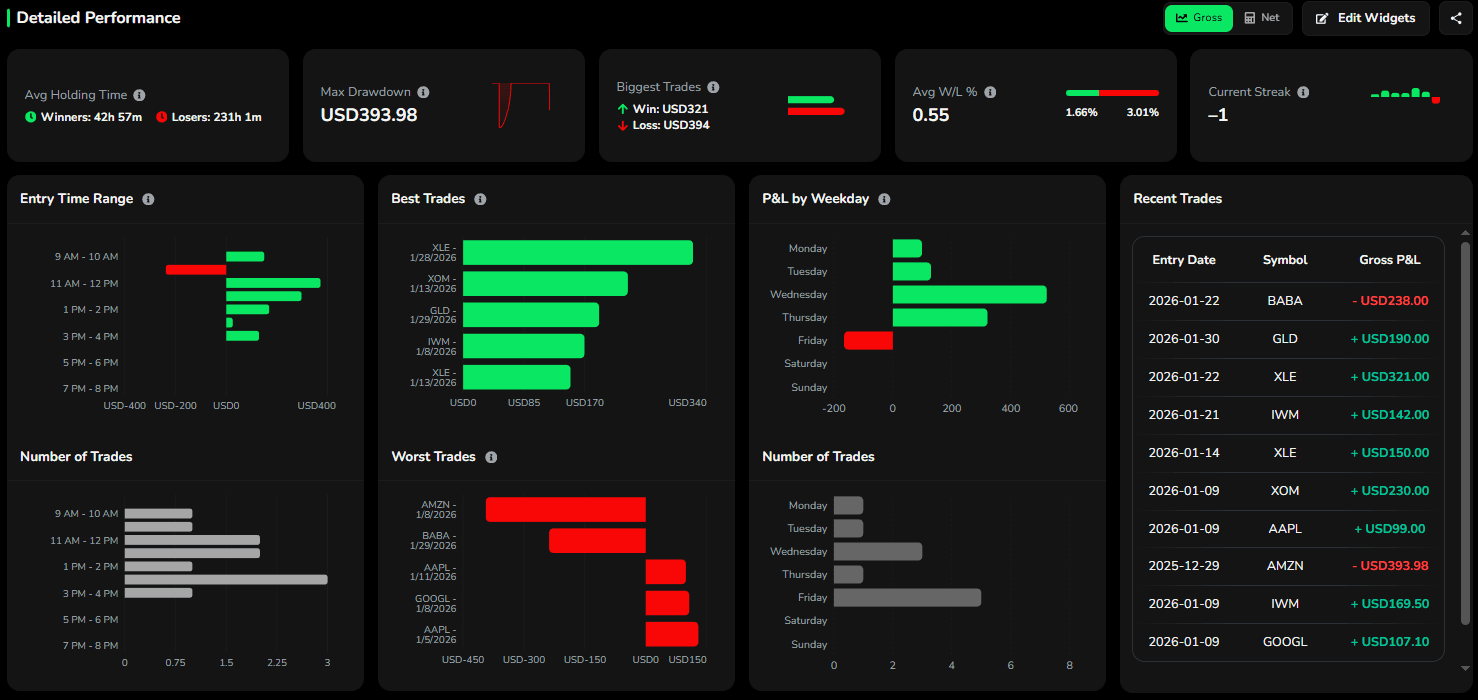

Risk & Trade Quality Metrics

- Max Drawdown: $393.98

- Average Win / Loss Ratio: ~0.55

- Biggest Winner: +$321 (XLE)

- Biggest Loser: -$393.98 (AMZN)

Losses stayed contained relative to account size, and winners were allowed to work.

Timing & Execution Insights

- Best Entry Window: 11 AM – 2 PM

- Worst Performance Window: Early morning entries (9–10 AM)

- Best Day of the Week: Wednesday

- Worst Day: Friday

Patience around entries continues to matter. Midday setups delivered the most consistency.

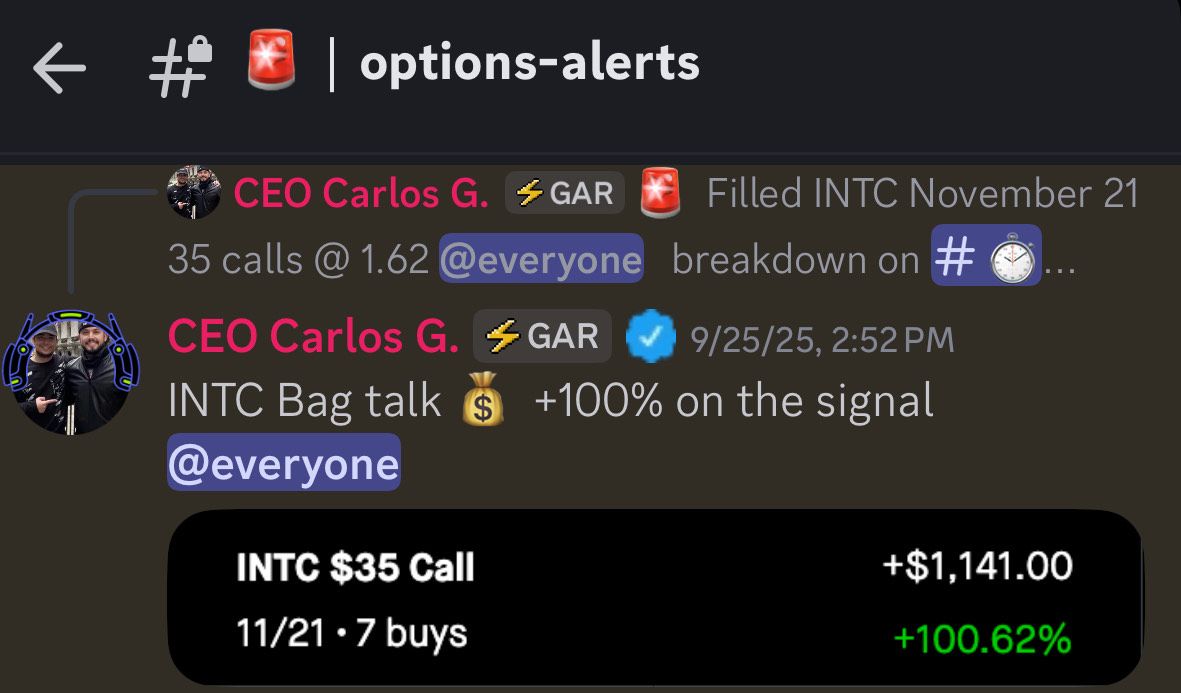

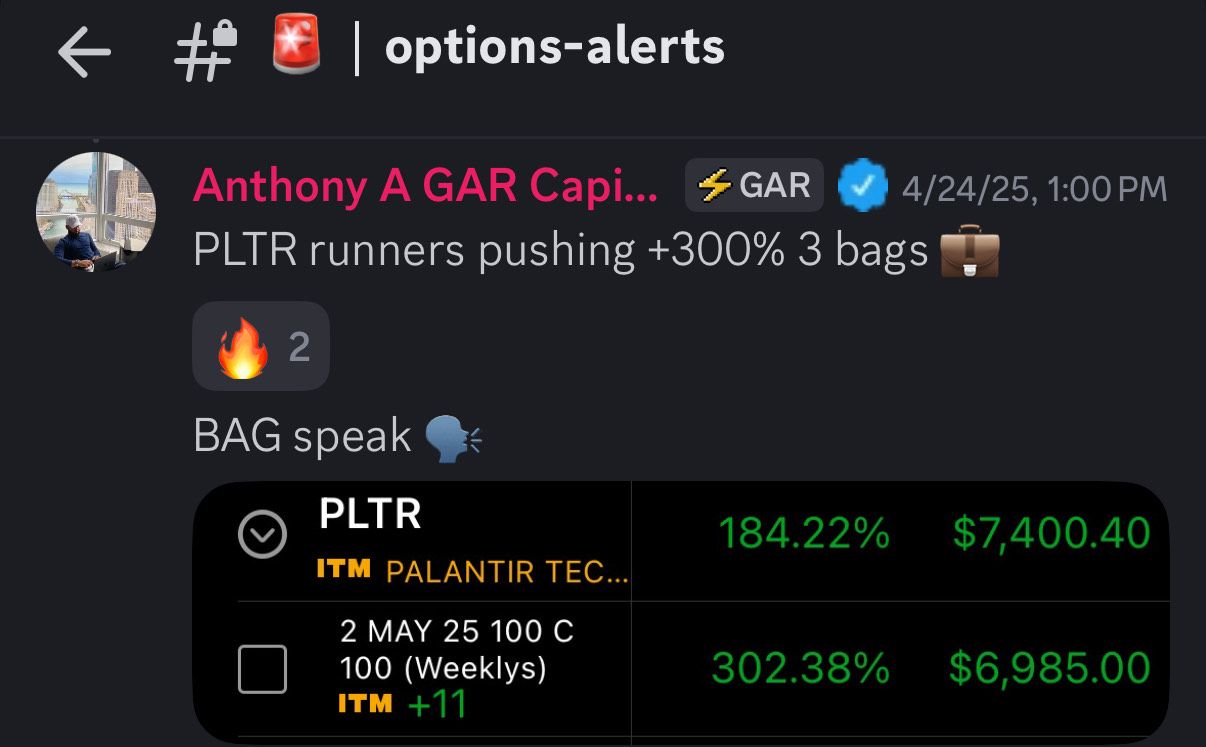

🏆 Best Trades of the Month

- XLE: +$321

- XOM: +$230

- GLD: +$190

- IWM: +$142

Energy and commodities led performance, with clean technical structures and favorable momentum.

Trades to Learn From

- AMZN: -$393.98

- BABA: -$238

Both losses reinforced the same lesson: respect invalidation levels and avoid forcing continuation when momentum fades.

Key Takeaways From January

- Quality > quantity continues to win

- Holding losers too long is still the biggest enemy

- Sector rotation awareness paid off

- Risk discipline protected the account during drawdowns

This was a professional month — not flashy, not reckless, just repeatable.

Looking Ahead to February

February will remain focused on:

- Clean technical levels

- Defined risk before entry

- Sector strength confirmation

- Avoiding emotional trades after large wins

The goal isn’t excitement — it’s consistency.

🔓 Want Access to These Trades in Real Time?

Our Lifetime Legacy Membership gives you access to:

- Options & futures & stocks trade alerts

- Entries, exits, and reasoning

- Long-term investment alerts

- All courses included (options + futures)

- Dedicated Discord channels

- Weekly watchlists & market prep

- Live trading sessions

This is everything GAR Capital offers, all in one membership.

👉 Join the Lifetime Legacy Membership

🚨 Final Day: Use coupon code JANUARY to lock in the discounted lifetime price before it expires tonight.

Trade smart. Manage risk. Stay disciplined.