Summary

October 2025 was a challenging month for the GAR Capital Masterclass account, ending with a -$1,473.33 loss and a 62.5% win rate. While this marks a rare red month, the bigger picture tells a stronger story: 66 total trades on the year, 55 of them winners, and a +$16,422.49 gain overall. Our focus this month was protecting capital and staying disciplined through tougher conditions. With November underway, we’re looking to tighten execution, wait for high-quality setups, and finish the year on a strong note.

Economic Data

- 📈 ISM Manufacturing PMI: Nov 3, 2025

- 📈 ISM Manufacturing PMI: Nov 5, 2025

- 📈 ISM Services PMI: Nov 5, 2025

📚 Deep Dive 📚

October Recap: A Tough Month, But the Bigger Picture Still Shines

Every trader knows it — not every month will be green. October tested our patience, discipline, and mindset. While we closed the month down -$1,473.33, the context matters: this comes after one of our strongest stretches all year.

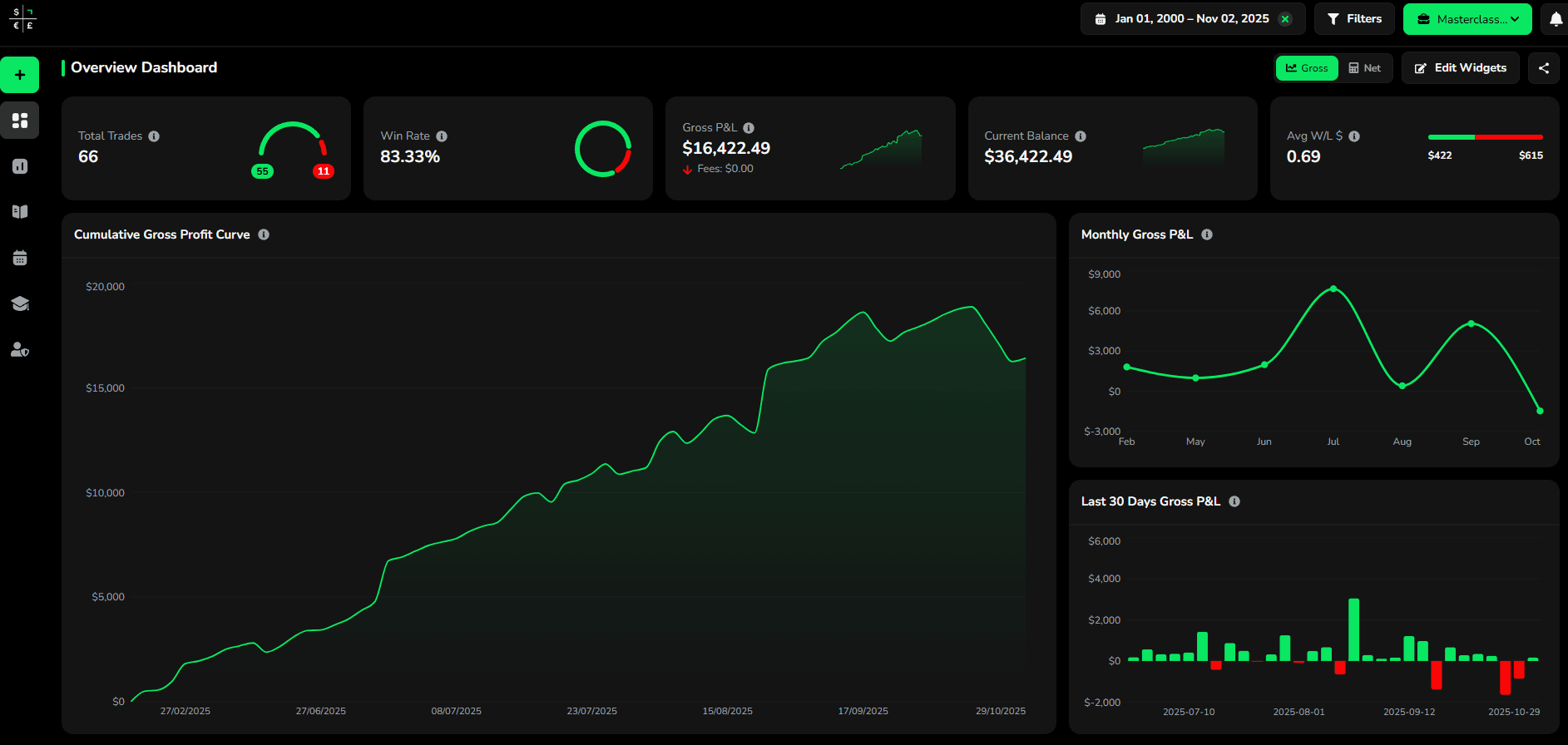

📊 Masterclass Account Overview (YTD)

- Total Trades: 66

- ✅ Wins: 55

- ❌ Losses: 11

- Win Rate: 83.3%

- Gross P&L (YTD): +$16,422.49

- Current Balance: $36,422.49

- Average Win/Loss: $422 / $615

This performance puts us well ahead of our January goal. Even with a red month mixed in, we’ve shown consistency, discipline, and strong momentum growth through 2025.

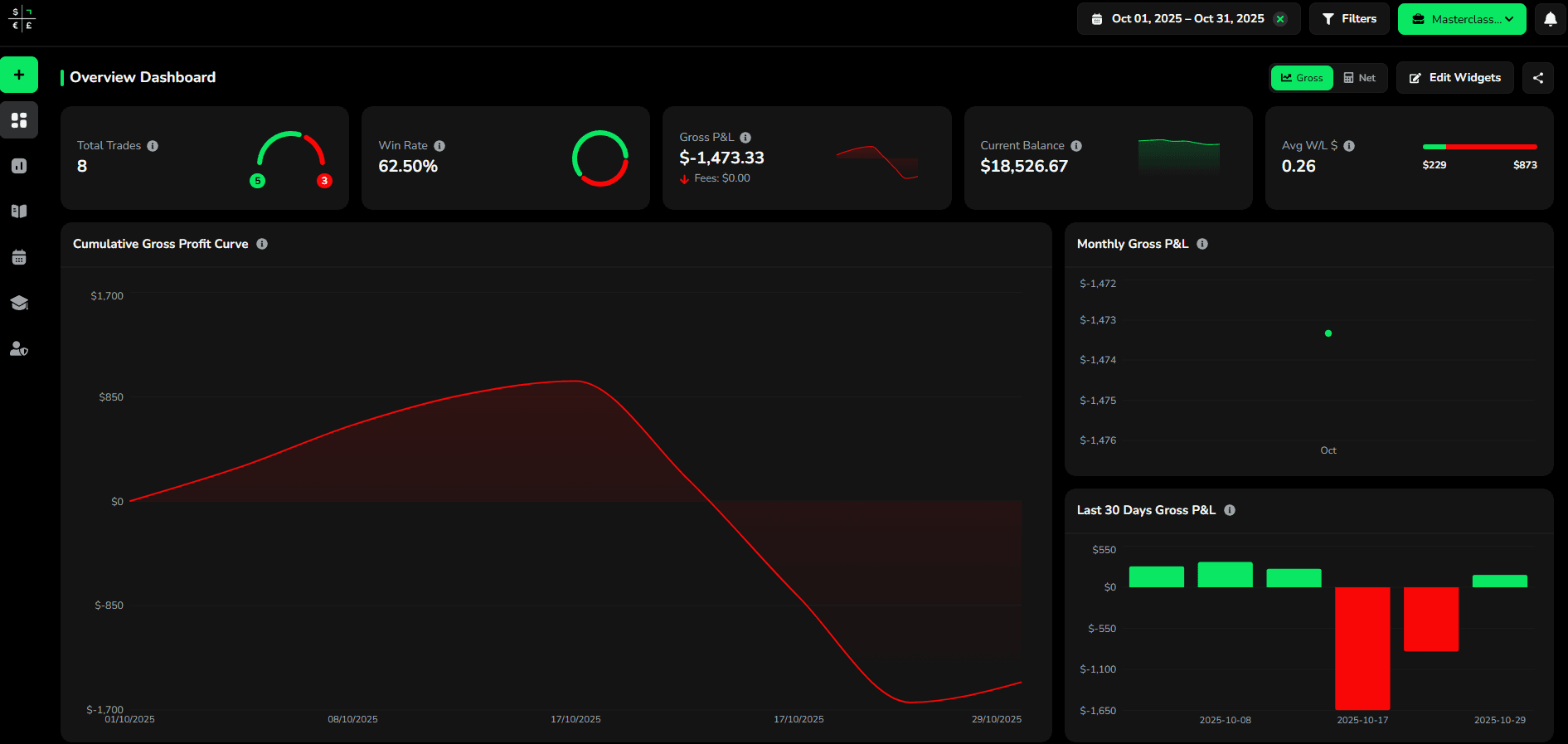

📉 October Performance Snapshot

- Total Trades: 8

- ✅ Wins: 5

- ❌ Losses: 3

- Win Rate: 62.5%

- Gross P&L: –$1,473.33

- Average Win/Loss: $229 / $873

October came with volatility and fewer clean setups. The focus going forward will be on risk control — cutting losses quicker and staying patient for higher-probability setups going through November.

🧠 Key Takeaways

✅ Staying disciplined during red weeks keeps us in the game long enough to win the long-term battle.

✅ Even when P&L dips, sticking to risk management preserves the account.

✅ Quality setups > quantity — fewer trades, higher conviction.

🔮 Looking Ahead

November is all about getting back to structure and execution — trading only when the setup meets our plan. The market continues to reward patience, and we’ll be ready to capitalize when momentum returns.

Bottom Line:

We had a rare red month — but after 11 green ones and an 83% win rate YTD, the story remains clear: discipline wins. Let’s keep pushing forward and finish the year strong.