Summary

This was A BAG WEEK - with a 4-1 record and some trades that really hit big.

Market Watch

Economic Data

- 📈 ADP NON-FARM EMPLOYMENT CHANGE: Apr 30, 2025

- 📈 US NFP PAYROLL REPORT: May 2, 2025

- 📈 US ADVANCE GDP : Apr 30, 2025

📚 Deep Dive 📚

Options Trading Weekly Recap – April 21–25, 2025

This was A BAG WEEK - with a 4-1 record and some trades that really hit big.

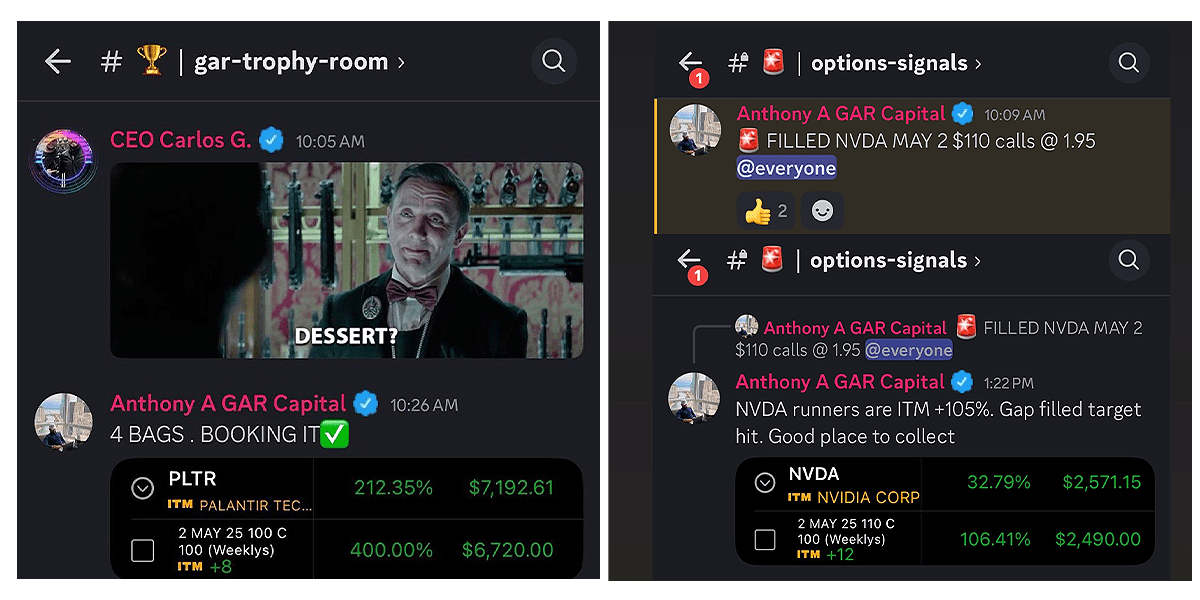

The star of the show? PLTR May 2 $100 Calls — they exploded on Friday for a massive +600% gain. If you held your runner, you likely locked in over +400%. It was a clean breakout, called in advance, and played to perfection.

Right alongside PLTR, we had another Friday banger: NVDA

May 2 $110 Calls. The trade hit +45% early, but the real win came when it pushed through our gap-fill target for +110% on the runner. Just a beautiful setup and a smooth play.Gold came through too. We hit GLD puts twice this week — both the April 25 and May 2 $300 Puts hit for +45%. Super solid results, and a great example of what happens when you stick to your plan and stay consistent.

Our only red mark this week was GOOG Apr 25 $145 Puts — the earnings report crushed the setup. Still, it gave a +10% window intraday for anyone who trimmed quick - and we let everyone know. Can’t win ‘em all, but the risk was managed.

Looking ahead — we’ve got two open trades going into next week.

NKE May 16 $60 Calls: early swing, technical dip buy, and a trade deal theme in the mix — needs time.

AMZN May 2 $200 Calls: already green at +10%, and we’ve got earnings coming next week. Expecting it to be a solid continuation play.

Weekly Trade Breakdown:

Closed Trades (4-1 W/L):

✅ PLTR May 2 $100 Calls → +600% monster breakout, massive runner for those who held)

✅ GLD Apr 25 $300 Puts → +45%

✅ GLD May 2 $300 Puts → +45%

✅ NVDA May 2 $110 Calls → +45% initially, +110% on runner filled gap target perfectly)

🔴 Loss of the Week:

GOOG Apr 25 $145 Puts → 💀 Earnings blowout invalidated setup — hit +10% intraday for early trimmers)

📈 Open Positions:

- NKE May 16 $60 Calls → -24% early swing, technical + fundamental play — patience required)

- AMZN May 2 $200 Calls → +10% set for continuation into next week’s earnings)

Overall? A killer week with clean setups, great execution, and big profits. We stayed disciplined, followed the plan, and let the trades work. On to the next week!

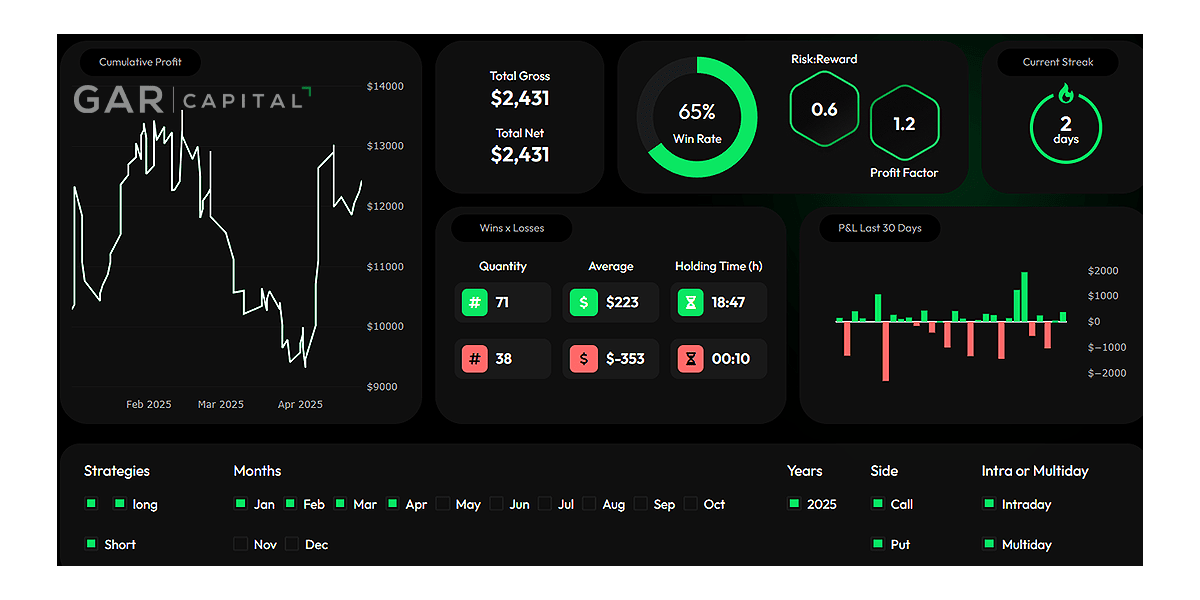

Here is a look at our GAR Capital Options Trading Journal YTD:

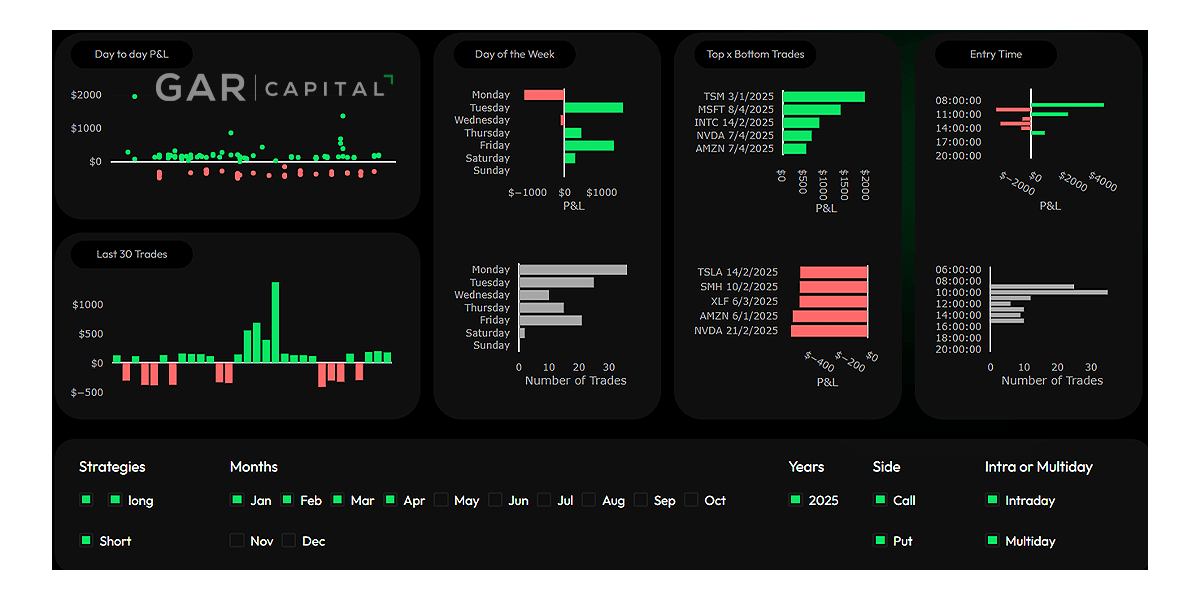

A more detailed snapshot of our Journal Data:

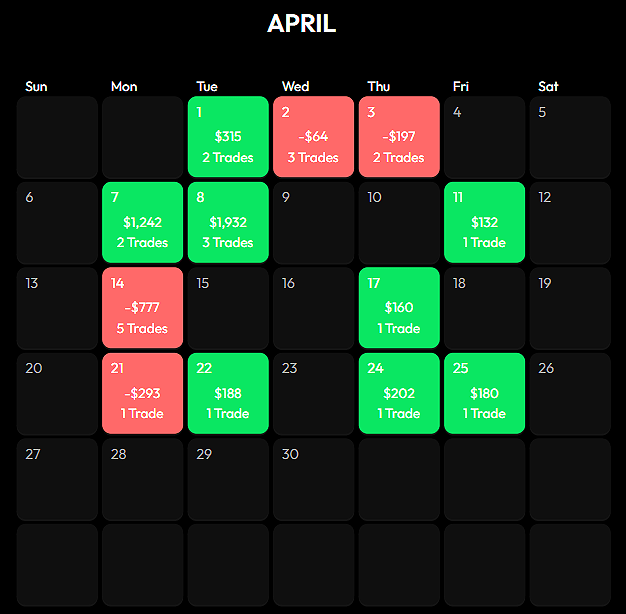

And a look at our April Calendar view of our Journal:

Get your Trading Journal Here