Summary

D-Wave Quantum Inc. (QBTS) has delivered a stunning run from $9 to $33, making it GAR Capital’s top gainer of the year. Backed by strong momentum, a clean technical breakout, and our conviction in quantum computing, this call has been one of our most accurate of 2025. With upside targets in the $40–$45 range, the QBTS story may still be far from over.

Economic Data

No economic data this week..

📚 Deep Dive 📚

QBTS: From $9 to $33 – Our Biggest Gainer of the Year 🚀

From Hidden Gem to Top 10 Play of 2025

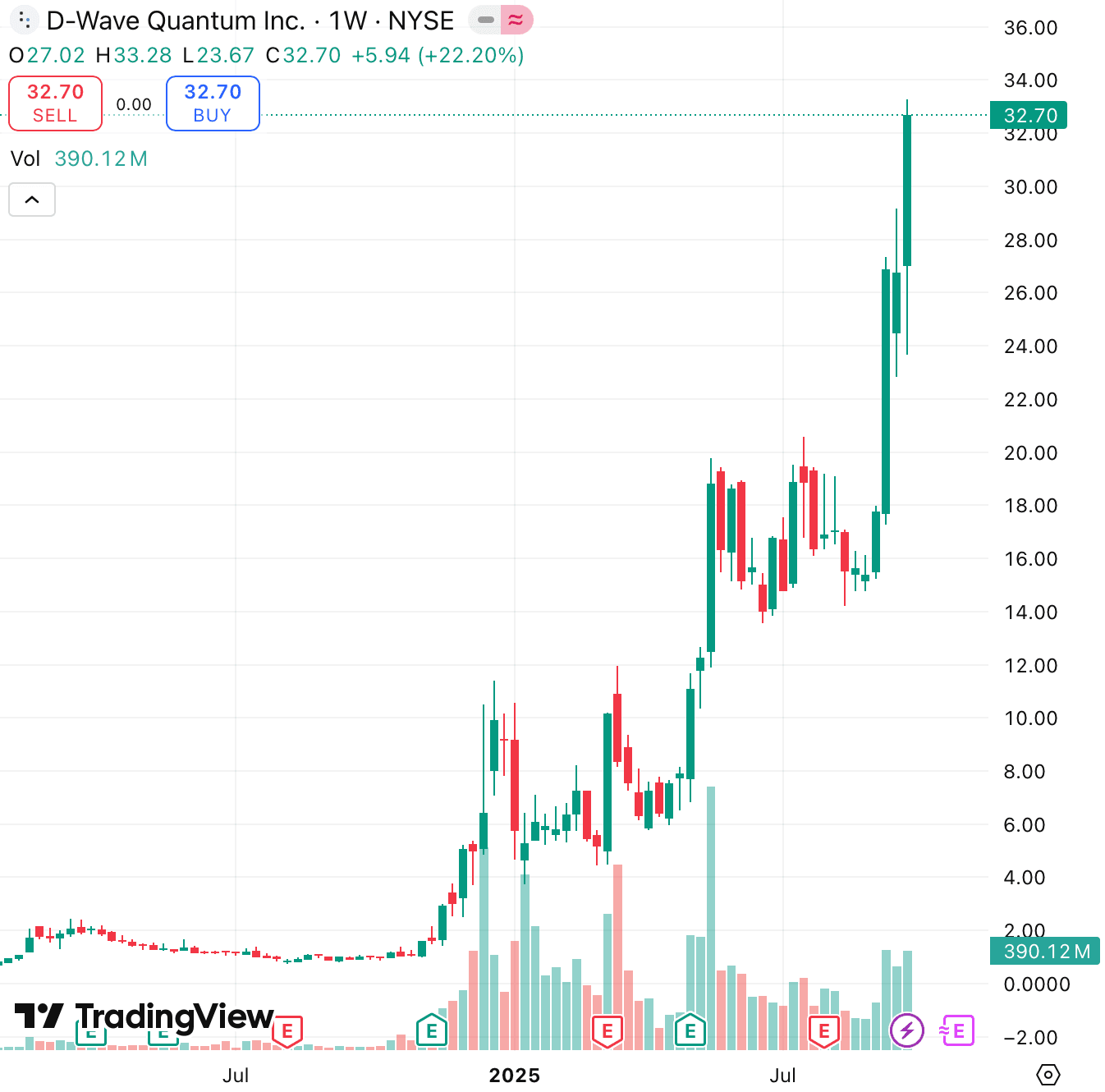

When we first spotlighted D-Wave Quantum Inc. (QBTS) as one of our Top 10 Stocks of the Year, shares were trading near $9. Fast forward to today, QBTS has surged to $33, delivering the biggest gain of the year across our portfolio picks.

This is exactly why we emphasized the opportunity in quantum computing: the growth runway, unique tech moat, and untapped market were simply too powerful to ignore.

We were early, we were loud, and we were right on the money.

Chart Levels: Technical Runaway Breakout 📈

- $9.00 entry zone → Our accumulation area, where conviction was strongest despite low sentiment.

- $15.00 resistance → Once broken, momentum accelerated with heavy volume.

- $25.00 breakout → A critical psychological and technical level that flipped into support.

- $33.00 current high → A massive gain of nearly 270% from our original call.

Looking forward, Fibonacci extensions and momentum targets point to $40–$45 as the next potential leg higher.

Why QBTS Was a Conviction Call 🎯

Our thesis was simple yet powerful:

- Quantum computing adoption curve → Enterprises are beginning to explore practical applications.

- First-mover advantage → D-Wave’s quantum annealing model gives it a unique edge in the space.

- Technical setup → Cheaper price and accumulation gave us asymmetric risk/reward near $9.

We leaned bullish when others ignored it — and today, that conviction has paid off in a huge way.

GAR Capital Was On Point 🏆

We don’t just call names - we track levels, highlight catalysts, and provide conviction when it matters. QBTS has become the poster child of why our Top 10 list is more than just headlines - it’s about actionable performance.

This wasn’t luck. It was preparation meeting opportunity.

Final Takeaway ✍️

QBTS has secured its place as our biggest gainer of the year, running from $9 to $33 with strong momentum, fundamentals, and growing sector demand.

And the story isn’t over yet - upside targets in the $40–$45 range remain firmly in play.

👉 Stay bullish — we called it early, we tracked it perfectly, and we’ll keep guiding you through the next levels.