Summary

Here is what the data tells us.

Economic Data

- 📈 FOMC Rate Decision & Press Conference: May 7, 2025

📚 Deep Dive 📚

“Sell in May and Go Away?” Here’s What the Data Actually Says — And How to Trade It

Every spring, the old saying pops up: “Sell in May and go away.” It’s one of the most famous Wall Street clichés - but is there any truth to it? And more importantly, how should traders and investors actually approach the months ahead?

What the Data Tells Us

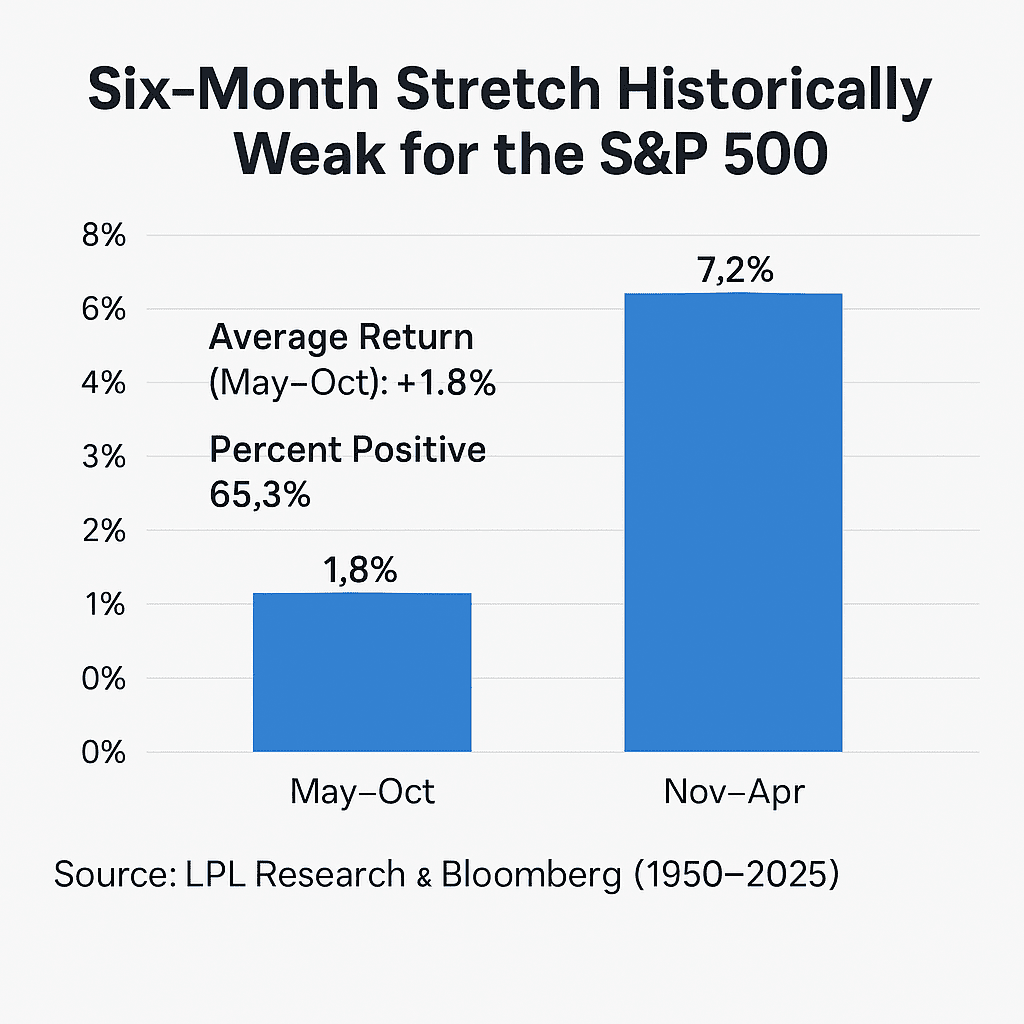

According to data from LPL Research & Bloomberg (1950–2025), the six-month period from May to October is historically the weakest stretch for the S&P 500:

- Average Return (May–Oct): +1.8%

- Percent Positive: 65.3%

Compare that to Nov–Apr, which shows:

- Average Return: +7.2%

- Percent Positive: 77.3%

Translation? The market can rise from May to October — but the returns are historically weaker and less consistent than the winter-spring stretch.

What This Means for Traders

If you’re day trading, this seasonal shift doesn’t mean you pack it in and wait until November. But it does mean:

- Expect more chop, less trend: Markets tend to move sideways during summer months as volume drops and conviction fades.

- Don’t force trades: If setups aren’t clean, don’t chase. This is when bad habits get expensive.

- Tighter stops, smaller targets: Be nimble. Trade the range. Summer tends to reward scalpers more than swing traders.

- Macro & news matter more: Tariff news, earnings, and economic data may create bursts of volatility — use them.

What This Means for Investors

For long-term investors, “Sell in May” can be misleading. Here’s why:

- 65% of May–Oct periods are still positive — so exiting entirely could mean missing gains.

- Timing the market is hard — but adjusting your expectations for seasonal softness is smart.

- This is a great time to:

- Rebalance your portfolio.

- Trim into strength.

- Add during weakness.

- Sit on cash for better entries.

Context Matters in 2025

This year isn’t your average May:

- Tariff risks are back on the table — pressuring tech and global stocks.

- Berkshire Hathaway’s cautious tone and record cash hoard suggest big money isn’t in a rush to deploy capital.

- The S&P 500 is down 6% YTD, while defensive and cash-rich names are leading.

That tells us this could be a “Sell in May” year where caution pays — especially for overvalued growth names.

Final Take

“Sell in May” isn’t a trading rule — it’s a signal to adjust your strategy.

- If you’re trading: Stay sharp, trade what you see, and manage risk tightly.

- If you’re investing: Use seasonality to your advantage — don’t sell everything, but be selective and tactical.

"Stay disciplined. Stay patient. And remember: capital preservation is also a position. Happy Trading!"