Summary

Weekly Options Recap: GAR Capital locked in 6 straight wins, including +200% on HIMS and +60% on NVDA. Momentum, headlines, and sharp execution drove another winning week.

Market Watch

Economic Data

- 📈 US CPI Inflation Data: May 6, 2025

📚 Deep Dive 📚

Options Trading Recap: May 5–May 9, 2025

GAR Capital Weekly Performance – Strategy, Execution, and Lessons

6-for-6 closed trades this week!

- ✅ TSLA 5/9 $300 Calls +50%

- ✅ HIMS 5/16 $50 Calls +40%, Runner +200%

- ✅ AAPL 5/16 $190 Puts +40%

- ✅ NVDA 5/9 $119 Calls +60%

- ✅ UAL 5/16 $80 Calls +45%, Runner +120%

- ✅ PLTR 5/16 $45 Calls +45%

Strategy, Execution, and Lessons

Another killer week in the books for GAR Capital. From quick-hit intraday wins to monster multi-day runners, our blend of technical precision, headline plays, and sharp exits delivered big once again.

Below is a breakdown of our closed trades this week, including key takeaways for traders learning from the setups:

✅ TSLA $300 Calls (5/9 Exp) +50%

Strategy: Dip buy on early-week weakness

Tesla was down -4% at open Monday. We saw this as opportunity, not weakness. By entering calls near the session lows, the stock reversed swiftly — and we locked in a +50% gain within 3 hours.

📚 Lesson: Fast-moving names like TSLA reward well-timed dip buys, especially after overdone pullbacks on no major negative catalyst.

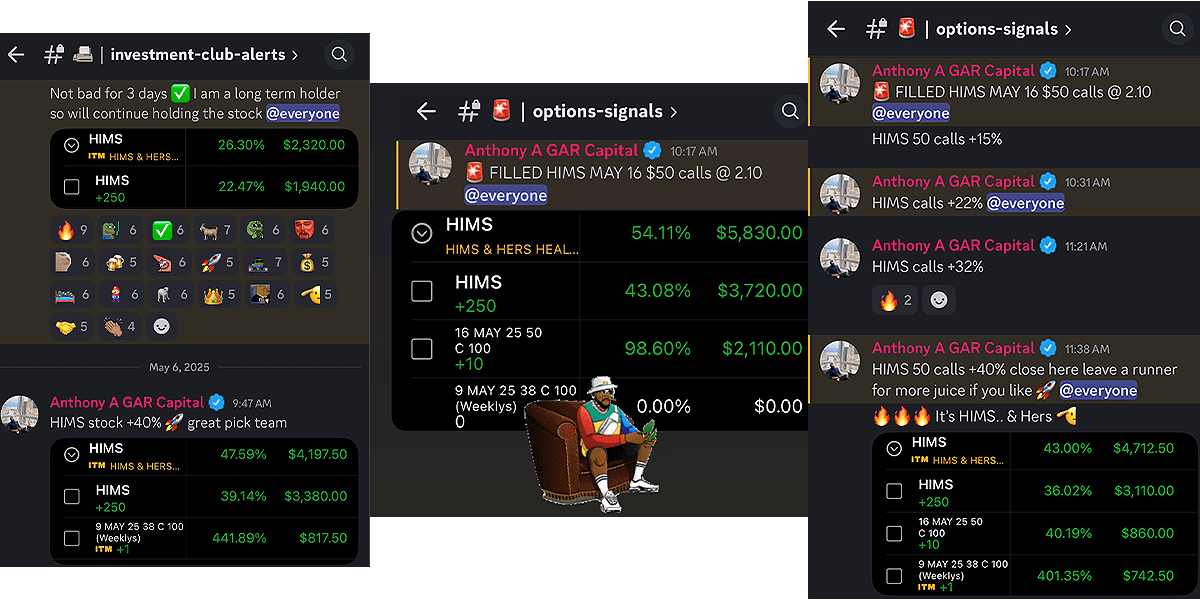

✅ HIMS $50 Calls (5/16 Exp) +40%, Runner +200% 🚀

Strategy: Breakout confirmation with defined target

We caught the $45 breakout and aimed for $55 — which hit perfectly. Our calls went deep ITM, and the runner exploded for a +200% gain, making it our trade of the week.

📚 Lesson: Momentum + clear price target = high-conviction setups. Always leave a runner when the trend looks strong.

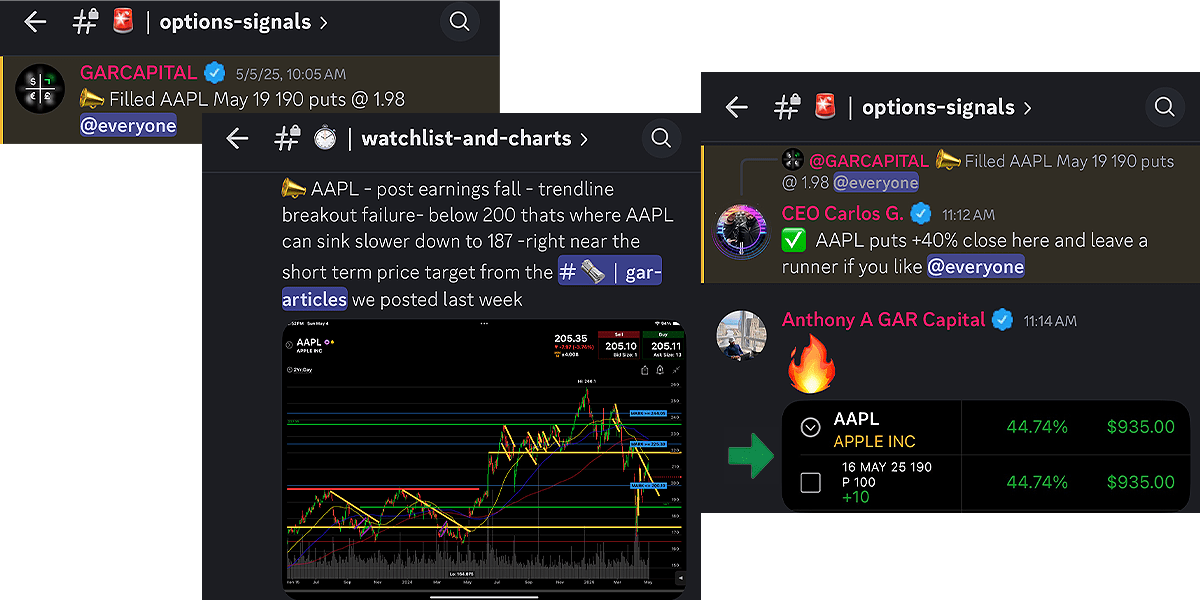

✅ AAPL $190 Puts (5/16 Exp) +40%

Strategy: Weakness spot + hedge protection

AAPL began to show early signs of weakness, so we added puts. It was also a smart hedge against our call-heavy exposure. Result? A smooth +40% win on a red day, a GOOG AAPL headline helped as well.

📚 Lesson: Don’t forget to hedge. Protecting gains can also lead to profit.

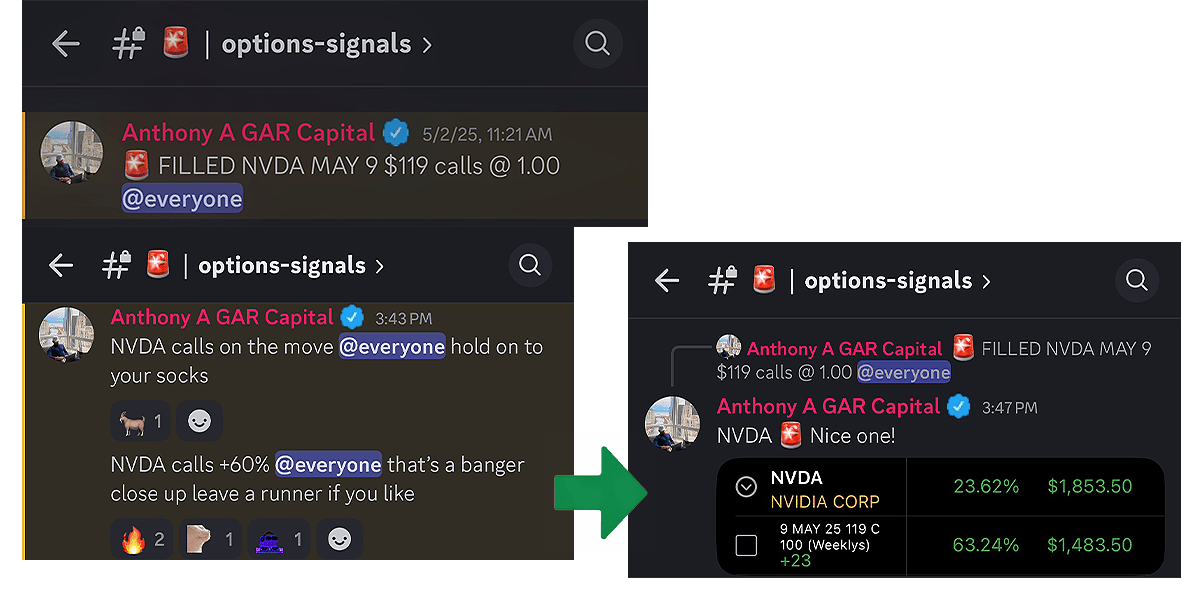

✅ NVDA $119 Calls (5/9 Exp) +60%

Strategy: Held from last week with the $120 level as a target, patience paid off

This trade mid-week started to look rough as the day to day chop and theta started to eat our premiums, down as much as -70%. But then came the CNBC headline: "Trump Administration Prepares to End Chip Export Restrictions" and in 3 minutes, our calls went from deep red to +60% profit and we BOOKED it.

📚 Lesson: Stay alert. Keep notifications ON. Be ready to act fast — headlines create volatility and opportunity.

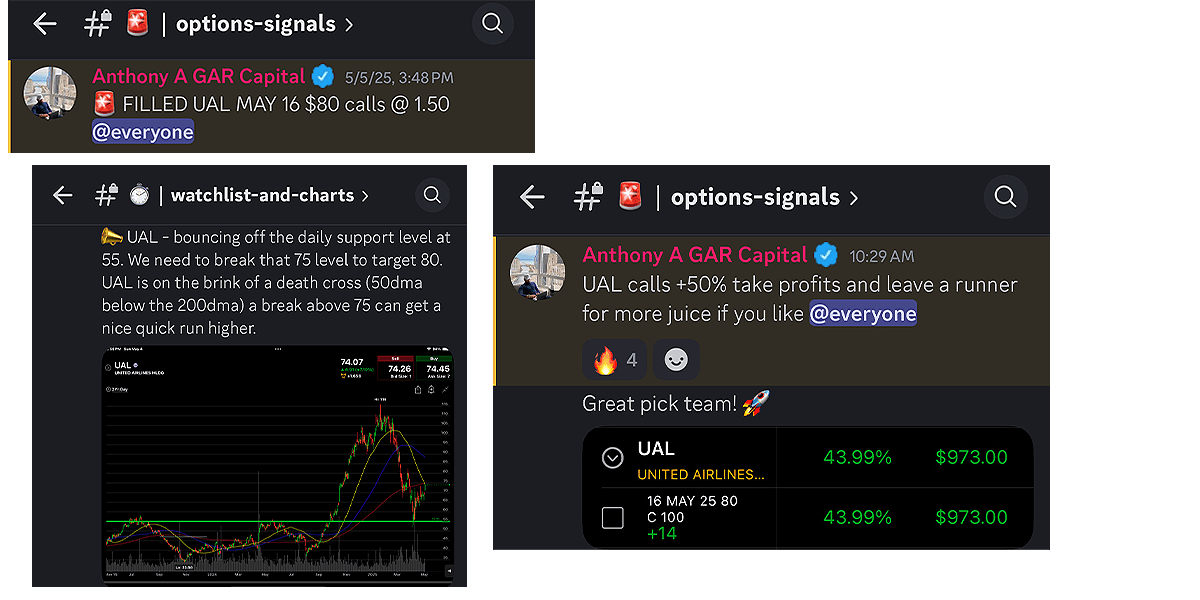

✅ UAL $80 Calls (5/16 Exp) – +45%, Runner +120% 🚀

Strategy: Technical breakout

Entered last week after a clean daily breakout over $72. The $80 strike was our target — and it hit. The rest ran for over +120%.

📚 Lesson: Technical analysis is bliss - and they still work in choppy markets. Trust the chart and manage size smartly and buy time with expiry.

✅ PLTR $45 Calls (5/16 Exp) +45%

Strategy: Dip buy and continuation

We’ve traded PLTR frequently — and this was a textbook bounce. We entered above the $115 zone and exited on the pop to $120.

📚 Lesson: Know your favorites. Repeating trades on familiar setups improves speed and execution.

Some of our trade sceenshots from the week:

Still Holding & In-Play

These trades remain active and will be managed into the new week:

- 🟡 TSLA $325 Calls (5/16 Exp) Currently -6% (ran as high as +20% intraday)

- 🟡 NKE $60 Calls (5/16 Exp) -55%

- 🟡 AMD $110 Calls (5/16 Exp) -54%

- 🟡 AMZN $200 Calls (5/16 Exp) -20%

Final Thoughts

This week showcased the power of being ready for anything — from intraday breakouts to overnight news-driven rallies. Our traders benefitted from consistent prep, fast alerts, and disciplined exits. Education remains key: every trade is either a profit or a lesson.

Join our Discord Community and don’t miss our next trade!

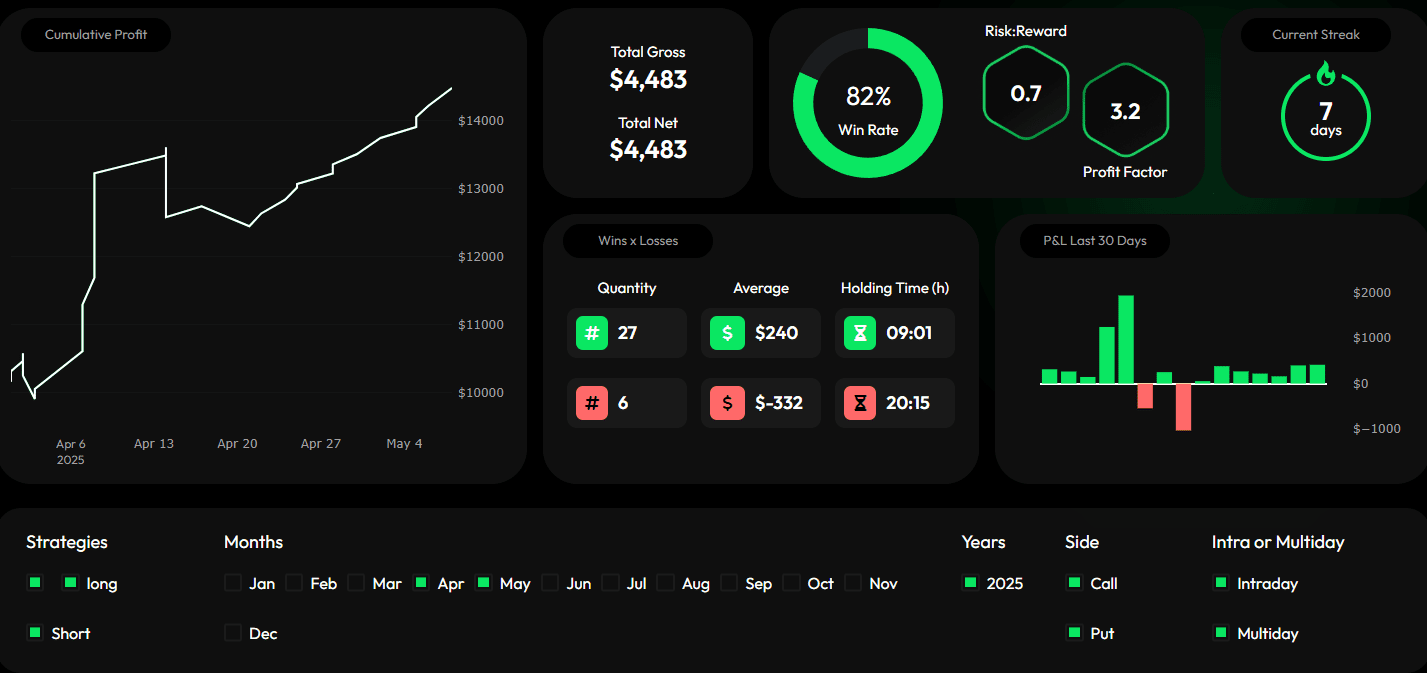

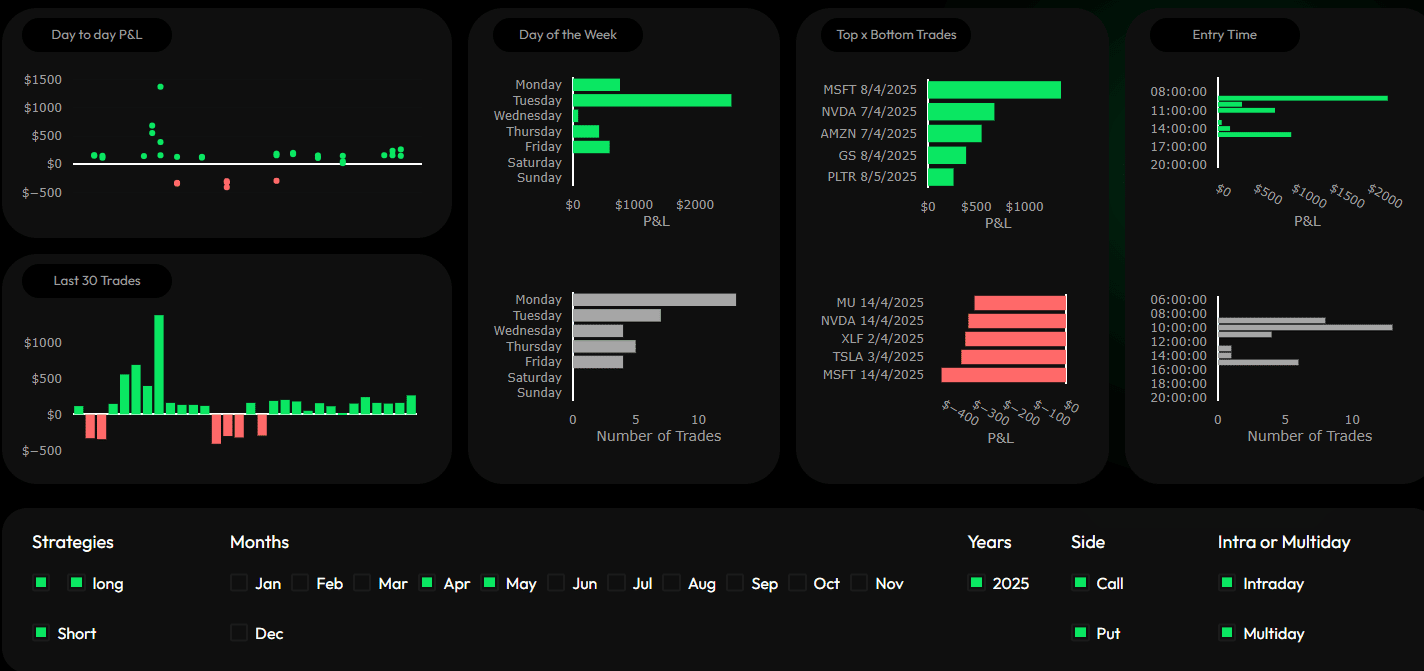

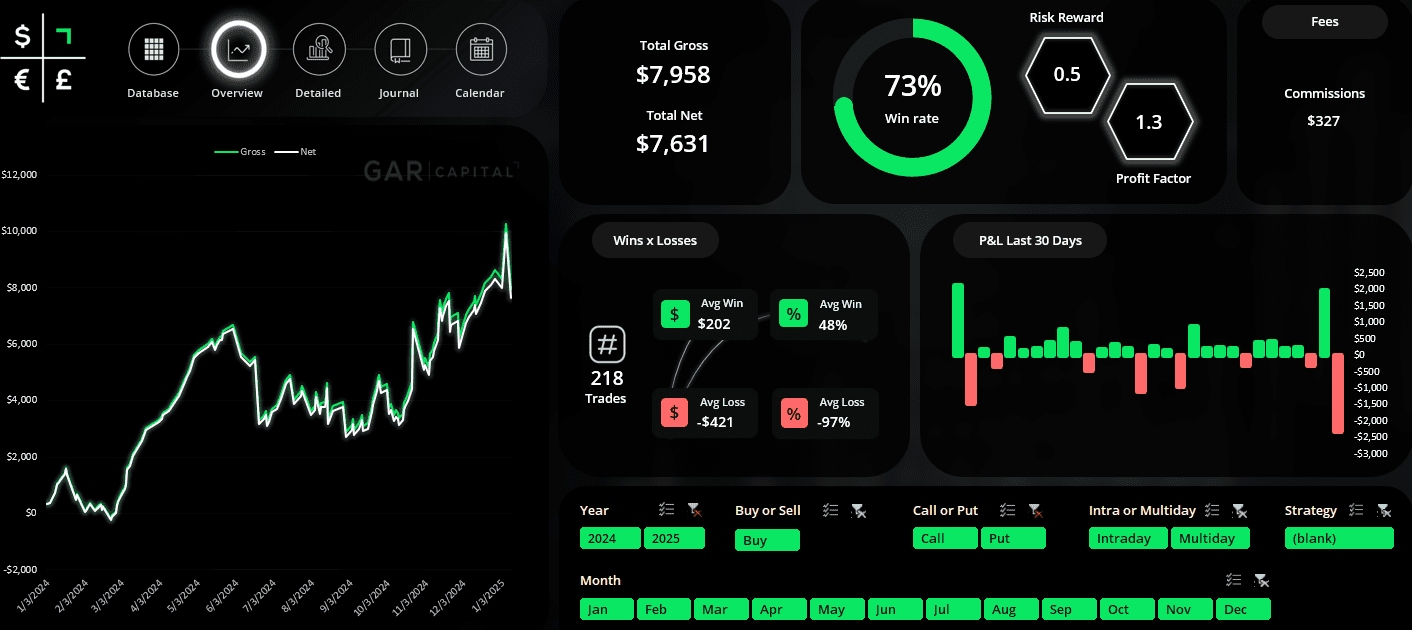

📓 Don’t Trade Blind – Use the GAR Capital Trade Journal

We track every single options trade in our GAR Capital Trade Journal — with timestamps, entries, exits, and performance stats. It’s a must-have tool for serious traders looking to learn, review, and grow. Transparency is everything, and our journal is proof of the work behind the results.

A snapshot of our Journal Details April-May 2025:

A snapshot of our Journal Details for year 2024:

🚨 Heads-Up: Price Increases Coming June 1st! 🚨

As GAR Capital continues to grow, so does the support needed to serve our amazing community. Starting June 1st, we’ll be adjusting our pricing across all services.

💡 Lock in your rate now and take advantage of any current deals — because once June hits, the new pricing will take effect.

✅ If you’re a Masterclass or Lifetime member, you’re all set. This change does not affect you.

✅ If you’re on month-to-month, or have an annual membership, your rate stays the same as long as you stay active. Cancel and return later? You’ll be subject to the new rate.

🔥 Looking for the best value?

Go Lifetime Legacy Membership — get access to all our trade entries and exits across options, futures, and stocks, plus full Discord perks.

💥 Use code GARFOREVER for -40% OFF to LOCK IT IN — before prices go up in June!