Summary

Knowing when to take profits is one of the most difficult skills in trading. This guide breaks down the psychological battle between greed and fear, explains how position sizing affects emotional stability, and provides practical trade management strategies for options, futures, and swing trading stocks. Learn how partial profit-taking, structured targets, and proper risk sizing can improve consistency and long-term survival in the markets.

Market Watch

Economic Data

📚 Deep Dive 📚

When To Take Profits On A Trade

The Battle of Greed vs Fear

You’re in a trade.

You did your homework.

You had your analysis.

Your thesis made sense.

Now your position is green.

Unrealized profit is staring at you.

Cash number climbing.

Dopamine hits.

You feel amazing.

Now what?

Do you take profits and move on?

What if it keeps running?

What if this is the trade of a lifetime and you close too early?

What if you watch everyone else make more money than you?

Next thing you know…

“I’m holding the next one no matter what.”

That’s the spiral.

What’s Stronger — Missing Out or Losing Money?

Traders fight this every single day.

Is it worse to:

- Miss additional upside?

- Or give back open profits and lose outright?

The answer isn’t satisfying.

It depends on you.

Your personality.

Your liquidity.

Your financial stability.

Your portfolio size.

Your emotional tolerance.

Someone with a $1,000 position inside a $2,000 account feels far more pressure than someone holding a $100,000 position inside a $200,000 account.

Percentages are similar.

Psychology is not.

Liquidity drives behavior.

Risk Size Determines Emotional Stability

The lower the timeframe, the more precise you must be.

The higher the leverage, the tighter the margin for error.

The best approach to trading?

Choose a risk size that lets you sleep at night.

Ask yourself honestly:

If this position went to zero, would my life materially change?

If the answer is yes — you are oversized.

If the answer is no — you have flexibility.

The goal is always the same:

Maximize return.

Minimize risk.

But that only works when your sizing makes sense relative to your account.

Trading too small expecting massive returns leads to overleveraging.

One mistake and statistically — it’s over.

“I’d Rather Be Out of a Trade Wishing I Was Still In…

Than In a Trade Wishing I Was Out.”

That sentence alone can save careers.

Being slightly early on profits is survivable.

Being trapped in a collapsing trade destroys discipline.

Practical Trade Management Examples

Options Trading

Example: $10,000 account.

You enter a position and it’s up 20–30%.

Take partial profits.

If you own 4 contracts, sell 2.

Lock in gains.

Let the rest run toward your target.

If the remaining position rolls over and only reaches +5%?

Close it.

Momentum wasn’t there. Thesis didn’t accelerate. Risk removed.

Some options run 100%, 200%, 300%.

You don’t need the entire position to capture that.

Partial profits reduce emotional pressure and create consistency.

Futures Trading (Spooz, Gold, etc.)

Use structured increments.

- 10-point targets

- Sliding stop-loss adjustments

- Lock in gains progressively

Yes — volatility happens.

Wicks happen.

Headlines happen.

Stay focused.

Consistency beats hero trades.

Swing Trading Stocks

If you’re ever up and unsure what to do:

Remove your initial investment.

Example:

$10,000 becomes $12,000.

Withdraw $10,000.

Let the $2,000 profit compound.

Now you’re playing with house money.

Risk reduced.

Emotional pressure lowered.

Upside preserved.

So… When Should You Take Profits?

Here’s the honest answer:

Take profits at the point where you feel content enough to move on.

Contentment is different for everyone.

If you want higher returns, lower your position size.

Create structured targets.

Build consistency.

The best plan is the one you will actually follow.

Final Thoughts

The market isn’t going anywhere.

Pricing is imperfect.

Change is inevitable.

Adaptation is required.

Don’t rush.

Don’t force.

Don’t chase.

Trading is not about squeezing every dollar out of every move.

It’s about surviving long enough to catch the next opportunity.

Greed and fear will always battle.

Discipline is what wins.

— GAR Capital

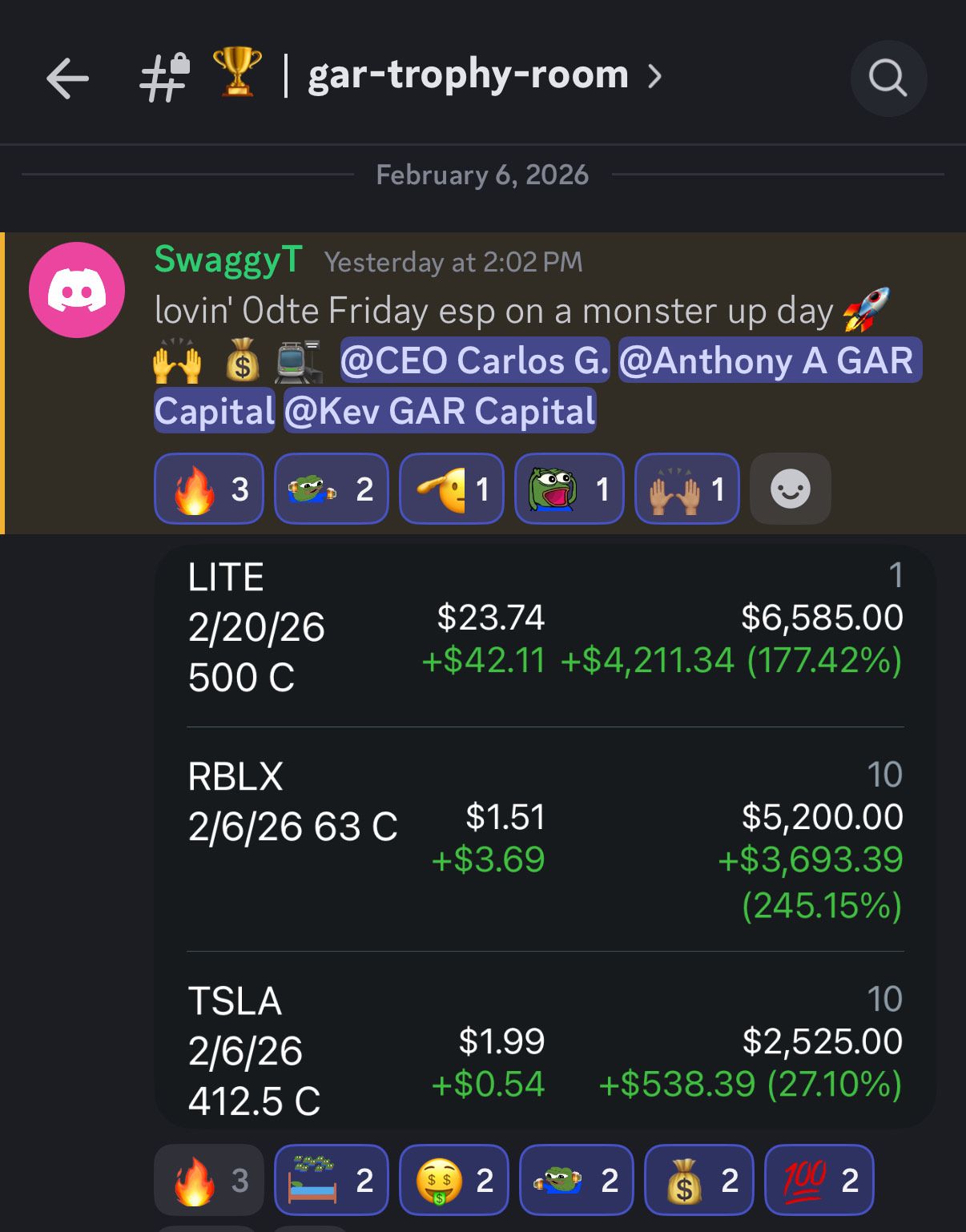

Join the GAR Capital Masterclass — Enrollment Closes This Weekend

If you're serious about building real consistency in trading, this is where structure meets execution.

The GAR Capital Masterclass gives you direct access to our full trading framework — including live trade breakdowns, detailed risk management systems, and 5 private 1-on-1 sessions designed to refine your edge personally.

You’ll also receive lifetime access to our Options + Futures signals, stock alerts, live Discord trading sessions, and our complete on-demand course library.

Enrollment closes this weekend!

If you’re ready to stop guessing and start operating with structure, now is the time.